Chris Quill: It’s my pleasure this week to sit down with Ross Williams and Jason McDonald. These guys are both going to be talking about their views on the market currently and also potentially some ideas that they’ve been looking at in their own portfolios as well.

Ross Williams: Thanks, Chris. I’m broadly ambivalent on on the direction of the market at the moment. I can make plenty of arguments as to why it should be higher, and I can make plenty of arguments as to why it should be lower.

I’m not really going to try too hard to give a view because I don’t really have a strong view on equities that moment. But within within that, I think I can make a few cases for potentially cyclicals outperforming some growth stocks at the moment, meaning smaller cap, potentially. Looking at how that may be represented in index form, perhaps Russell 2001 versus Nasdaq short.

That ambivalence of the market has led me to come up with a long short pairs trade, which is market neutral. I don’t want to have too much directionality. I certainly don’t want to be short volatility in this environment and I don’t want to be spending too much theta because I just don’t have a strong view on the direction of certain stocks.

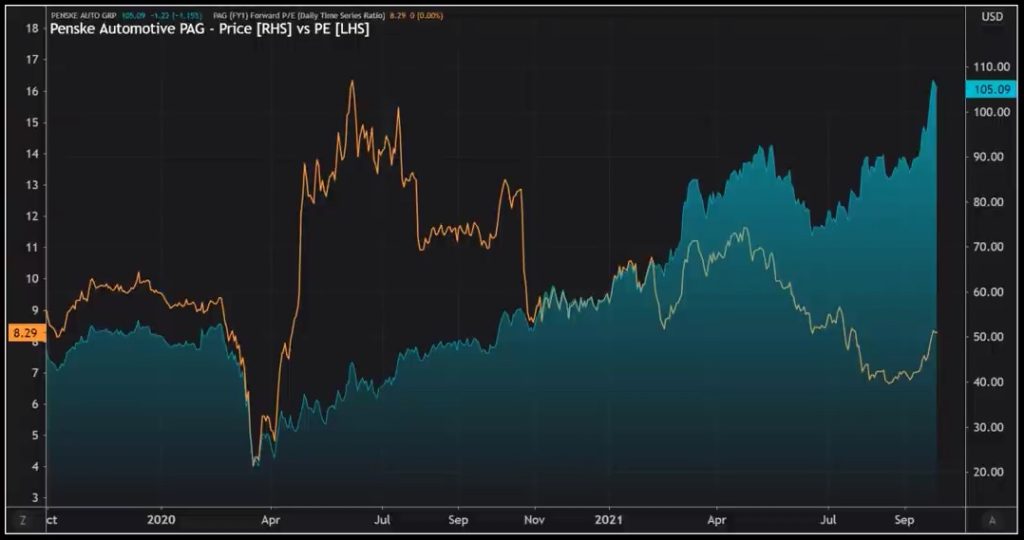

But I do have some more refined views on relative valuation. So my long this week is kind of boring in some respects: Penske Automotive, 8.5 billion dollars of market cap, they’re in transport services. They have huge truck dealerships. They they distribute power systems in Southern Hemisphere. They’ve got operations in Western Europe, they’ve got car dealerships in the US.

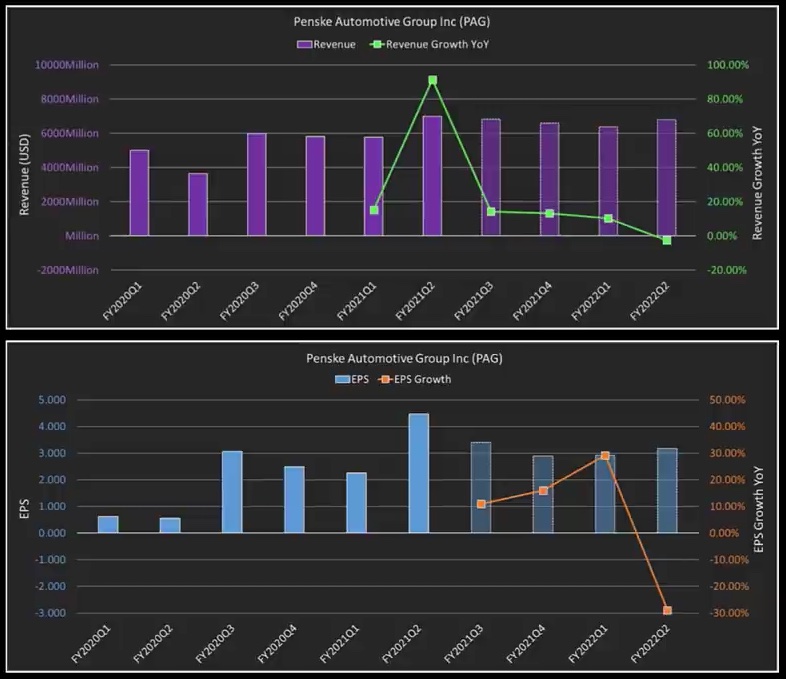

They’re very well known. They’ve been around forever, eight and a half billion dollars market cap trade is “cheap” or low PE; 8.5x 2021 earnings, 9.5x times next year’s earnings. They’ve just had a record quarter and it’s probably not too hard to understand why the second quarter was so good.

The market for commercial vehicles in particular with home deliveries, being exposed to commercial companies has it has also been really, really good. And they’re talking about having big backlogs in those sectors.

So in other words, for the next quarter, I think that they can still fulfill a lot of orders that would have been coming in in the second and third quarter of this year. So the Street seems to have got a little bit onto this belatedly after they reported in July, they’ve put it through a number of upgrades because the stock price is more sensitive to changes in earnings.

The market thinks they’re going to make $3.41 in October. I think they got to beat that. And I think they will beat that for a number of reasons, partly due to the backlog, but partly for this new business they’ve started called Penske’s Car Shop. And Penske’s Car Shop is a pretty good story.

It’s an offering whereby you can get online, you can compare motor vehicles, you can arrange financing, pick up delivery, trading values, etc.. That’s not exclusive to Penske, but it’s important for the second part of my of my trade. Old school car dealership trucks biased towards commercial as opposed to retail. And then this new growth bone on it, which is the the online car dealing business as well.

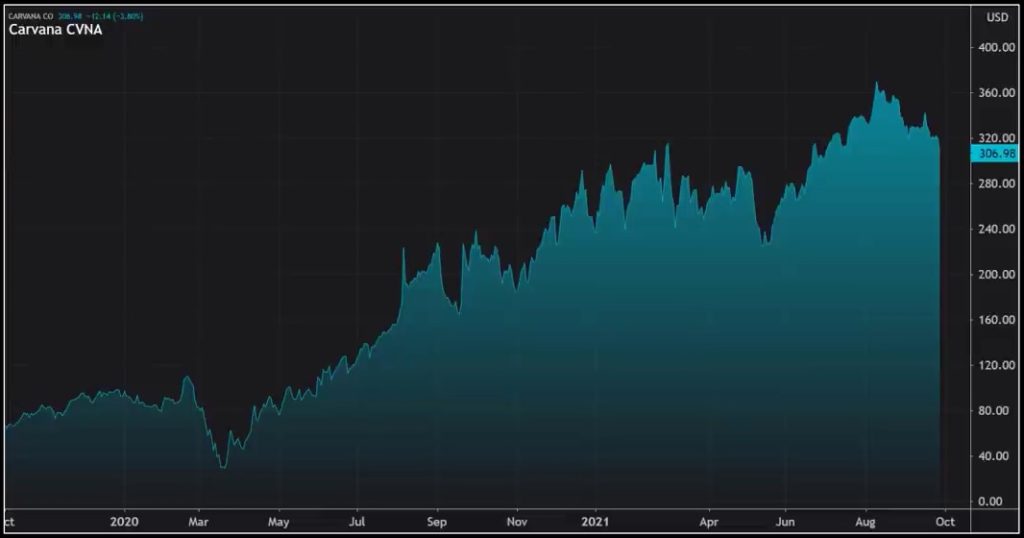

So that’s my long. The short I want to have against that is also in the automotive industry. It’s a company called Carvana. Now, I suspect for a lot of people there’s going to be a huge amount of brand awareness around this company, particularly people who are in the United States.

What you thought of it, because this kind of polarizing views out there, what is Carvana? Well, if you believe Carvana, they’re the Amazon of used cars, which I find a little hard to swallow. But fine, let’s just go with it for the for a minute; market cap of $55 billion, the stock’s up 33% year to date.

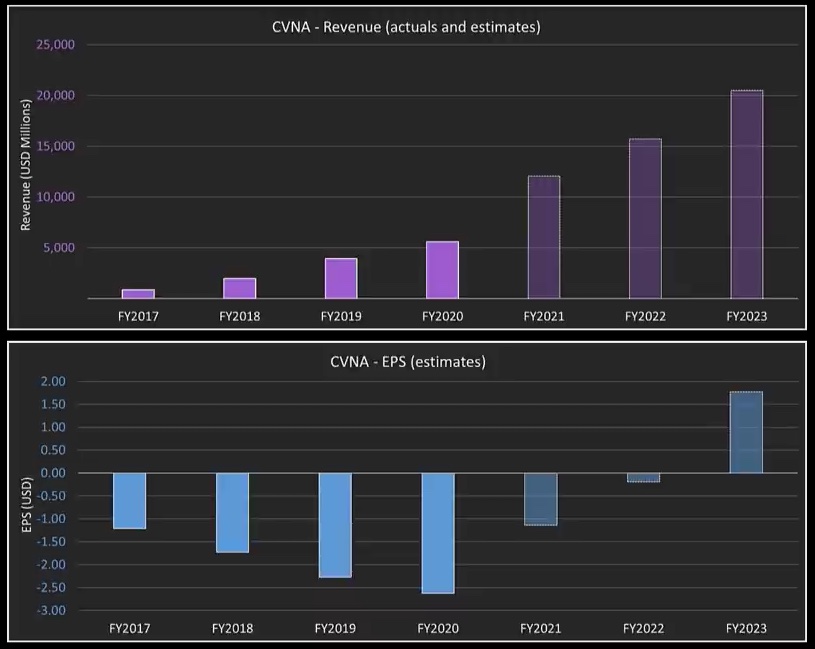

I don’t believe it ever made a profit back in 2018, losing $1.73 of earnings that accelerated to $2.28 of earnings. They lost two points, 63 in 2020, which seemed to be some kind of a of a trough in earnings. But I’ll get to that. I mean, it looks like they’re going to lose about 14 this year and break even some point and I think 2023.

And if you go out to 2023, they’re trading at about 180 times per year. So what’s the story? For what it’s worth, it’s a pretty good story, but there’s more to stocks than stories. There’s also this crazy thing called valuation. And I’ll get to that in a minute. You might say, well, why would you want to short this thing?

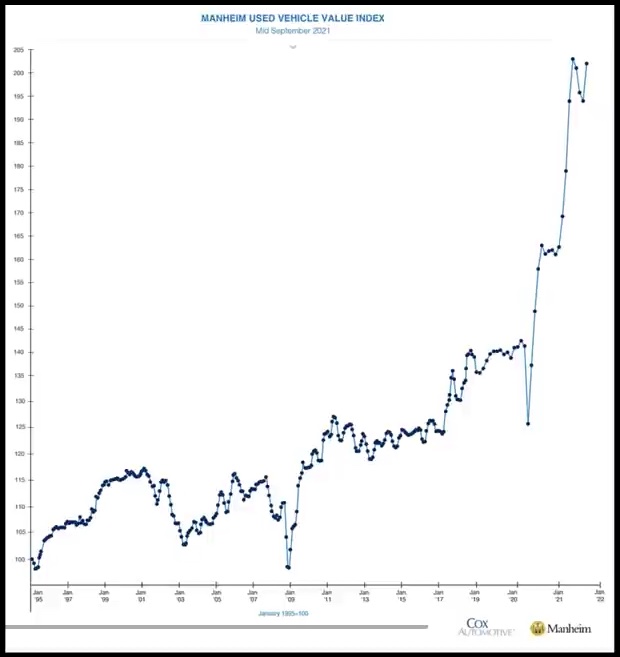

They’ve just had this great 12 months, EPS inflecting much, much higher, 100% revenue growth. Well, here’s the reason: If we look at the price of used cars for the last year and let’s just take September to September, so there’s a thing called the Manheim Used Car Index. And what it does is normalizes for differences in use, motor vehicles, aggregator price and it puts a nice line on a chart.

So from September ’20 till September ’21, that index was up 25%, give or take. If you want to go back to the second quarter of 2020, then it was up a hell of a lot more. But let’s just be conservative. Suffice to say, this is the best quarter that has ever been for the prices of used cars. Now the price.

Now the reasons for that are probably, I guess, relatively straightforward. Supply chain issues in new cars. So everybody switched in 2020. It looked as if financing was about to fall apart and it didn’t. There was super easy credit that was devoted to used cars. And then I guess these peripheral things about people not wanting to take public transport and moving around and all that kind of stuff, which probably helps a little bit as well.

But here’s the thing. If you’re in the business of selling used cars, particularly at volume, you’ve got to carry massive amounts of inventory. So what is this company been doing? They carried a ton of inventory for the last year, so big, big uptick in earnings or lack of losses, I should say, from $2 to $2.63 loss per share to a $1.14 loss per share was in part caused by this enormous uptick in the price of their used car inventory.

Basically, if you could make money selling used cars in the United States last year, there was something seriously wrong with you. So if you’ve got the view that the used car market ostensibly stays closed and used car prices continue to rocket, then you should buy Carvana because you’re probably going to get some good sentiment around that.

The valuation makes no sense to me, but valuation is really a catalyst to put shorts on. What is a catalyst? Well, look at a few. So in the last three months, there’s been a big pickup in loan delinquencies, particularly at the subprime end of things. So in other words, people simply just not making their car loan payments. What does that mean?

Typically when there’s hard defaults, it means that there’s more cars for sale in the wholesale market and prices tend to go down a little bit. I do think this used car price index chart that we bring up is totally unsustainable. That’s another one. There’s also a company called Rivian which is listing or should have listed this month. For some reason it’s been delayed now, that company, by the looks of it, which is a very exciting company, by the way, is probably going to list with a market cap of somewhere between 75 and $85 billion.

Now, if you haven’t heard, they’re in the EV space. I think that’s going to suck a bit of funding out of the sector and that’s going to hurt a lot of things. But I think it’s going to potentially come out of some of these really high growth, really well owned, more speculative things like Carvana.

But the thing I can’t get away from, and maybe this is a bit more long term, is that if you want to be the Amazon of cars, nothing wrong with that. Right. But most tech companies are based on the premise that you can pay this really, really high valuation, maybe a revenue multiple, because at some point sales grow and they stop, they start winding down expenses.

And when you wind down expenses, those revenues drop down weightings and then you’ve got to pay. But how do you do that when you’re forced to carry tons and tons of inventory and you can only really make so much on a used car? I mean, you don’t these companies don’t operate in a vacuum. So on the one hand, you’ve got Penske pouring big EPS upgrades, very undemanding, but with some growth, not a lot, but with some growth.

And the other hand, you’ve got this car company Carvana; it does exactly the same thing, but loses money doing it. And it’s got a $55 billion market cap with a few catalysts around it as well. So I think that the duration of this trade is probably three months, maybe two earnings cycles.

And if it really starts moving at that point, then it’s going to keep going for a lot longer. And I guess the nice thing about having long/short equity trades is we’re not giving up that time in which we need to be right. So yeah that’s my automotive is trade for this week.

Chris Quill: Yeah I’m I think that’s quite an interesting one. All right, Jason. Let’s go over to you. What have you been looking at?

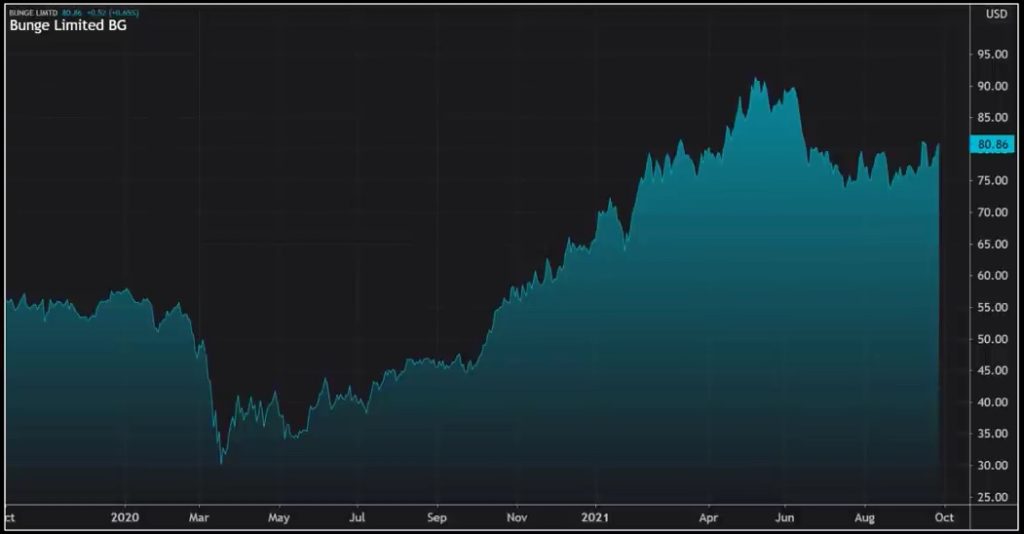

Jason McDonald: Well, interestingly, it’s quite amazing that we both seem to have come up with a mid-cap longs on quite undemanding PE ratings. So maybe that says something about our demographic. So my my long idea this week is a company called Bunge: a market cap of $11 billion, trading around $80. So what do they do? Pretty easy to understand.

They are a global agriculture business and food company. So they’re a major player in the global food supply chain, all the way from farms up to the end consumer. So more specifically, they’ve got five operating segments, 71% of their revenues generated in the segment called Agri Business, 23% in edible oil products. And then the other three segments are fairly small.

We’ve got milling products, that’s 4% of revenues, fertilizer 1%, and sugar and bioenergy at just under 1%. So the agri business is clearly the most important part of the business. So that is a global business which is involved in purchasing, storing, transporting, processing and the sale of agricultural commodities and commodity products. So what kind of products are we talking about?

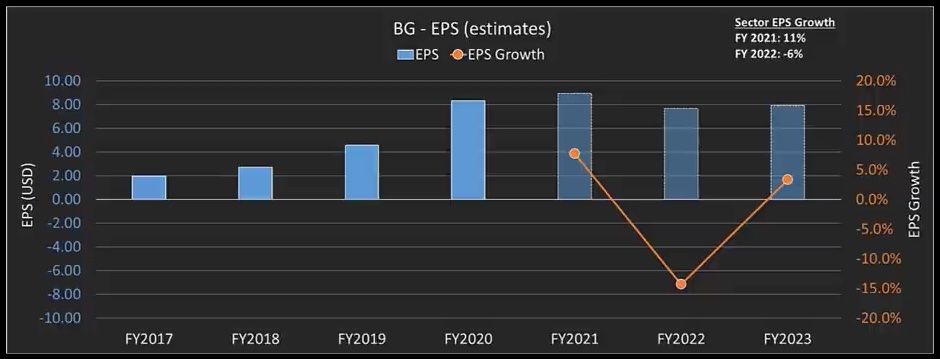

What about stuff like bulk oils and other products that are derived from vegetable oil, from the vegetable oil refining process? They are milling and producing stuff like wheat flour and bakery mixes. And as I mentioned, they are also involved in the fertilizer business. So on to the quantitative side of things. Not amazing EPS growth this year, but that is basically they’ve got very hard comps from last year.

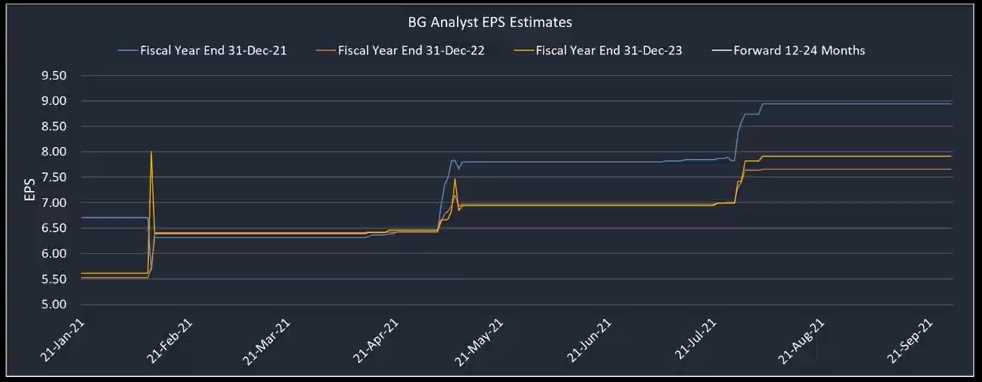

So their earnings are growing around 10% this year. But they had an enormous uplift last year about 80% on their earnings. And interestingly, and this is well, this is where the story starts for me with with one long stock is that for next year, the analysts have got a drop of 14% in earnings penciled in, and I think they’re wrong on that.

So for that, in order to be seeking completeness, these numbers compared to the average for the sector, you’re talking about 11% growth rate for the for the sector as a whole. So we’re, you know, just beneath the bunch Bunge and a drop of 6% next year in consensus estimates for the sector compared to 14% for these guys that’s for 2022 in the last month.

So after the last subsequent to the last quarterly report, interestingly EPS estimates for Bunge have been coming up. So they’ve been upgraded on a consensus basis by 12% and 15% respectively for this year and for next year. And I think that’s going to continue onto the the undemanding rating for this company. Their P rating for this year is nine times and it’s ten times for next year compared to so they’re trading at a small discount to the SEC.

So these sectors on average around 12 times this year, 13 times next year. And this is part of the story: they’re now throwing off quite a lot of free cash flow. So they’re currently really rewarding shareholders solely through the dividends which is about 2.7%. And that compares to about 2.5% for the sector, which again, not a bad return on a dividend basis.

Now, in terms of the qualitative factors behind the idea: just to put things into context, 2019 M2 money supply was growing around 4%. It’s now growing at 27%, which is, whatever you want to say, is the fastest rate in history. We know the numbers with respect to the Fed, their balance sheet has grown from 4.3 trillion to 7.3 trillion over that same period. And the total U.S. government debt has gone from 20 trillion to 28 trillion in two years.

So that’s up 40%. Essentially, the US government has basically borrowed and spent 2.4 trillion to replace 800 billion of lost economic activity, which has resulted in US savings of nearly one and a half trillion dollars. And in addition, if we think about the Biden administration is now looking to pass an infrastructure bill worth a trillion, you get the picture.

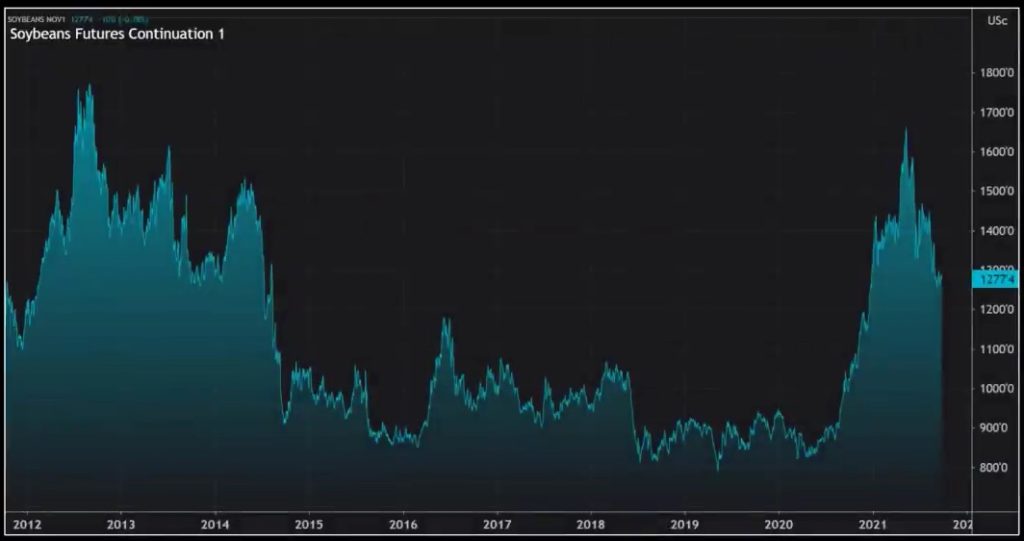

We’ve been hearing stories of shortages that have ranged from lumber to semiconductors to restaurant workers. So what I’m saying here is I am seeing inflation, particularly food price inflation. Have a look at grain prices. So I want to get to index here in terms of soybeans, but I am going to focus a little bit on these because it’s important for Bunge.

So soybeans basically goes into most of the food chain and it’s also soybean crush, which is used to feed livestock. Why is that important? First of all, it’s important because soybeans have basically been in a bear market for the best part of seven years up until the end of last year, where at some point they actually traded below production cost.

That has changed. You see similar things with corn. So these are structural changes that have occurred. That is basically down to Chinese imports. It’s down to higher fuel demand and overall high demand as restaurants reopen because this stuff goes into everything. As a result of that, almost every single company involved in agriculture and the food industry did really well in Q2.

We’ve also got changes taking place which affects their business positively. Biodiesel plants that convert soil into gasoline additive now speak for about 8 million tons of soybeans annually.

There’s only 25 million tons of that production in the U.S. So you’ve got US biodiesel, you’ve got Chinese feedstock policies all feeding in to these prices. Bunge is a major player in the global food supply chain, thanks to its focus on grains and exports. So they also, as I mentioned, have been throwing off strong free cash flow in the last couple of year.

I think they’ve got a pretty good business model, which is essentially protected against inflation. On that free cash flow point in the last 12 months, they’ve generated 1.6 billion of free cash flow, which gives them a fairly incredible 14% free cash flow yield.

Most of that they’ve been using to reduce debt, which means they now have a fairly unlevered balance sheet, which is now only in terms of its net leverage ratio. It’s down to 2.4 and it was up as high as 3.33 years ago. They haven’t been engaging in buybacks. All they’ve done is they’ve increased the dividend. So I think you’re looking at a good balance sheet here that’s throwing off decent cash that could be used in shareholder finding ways, let’s put it that way.

So these guys have got a much larger competitor called Archer Daniels Midland to bid for these guys back in 2018. That was rebuffed successfully and that was after Glencore had also bid for them a few months previously. So these guys, are kind of attractive in a sort of a sleepy way.

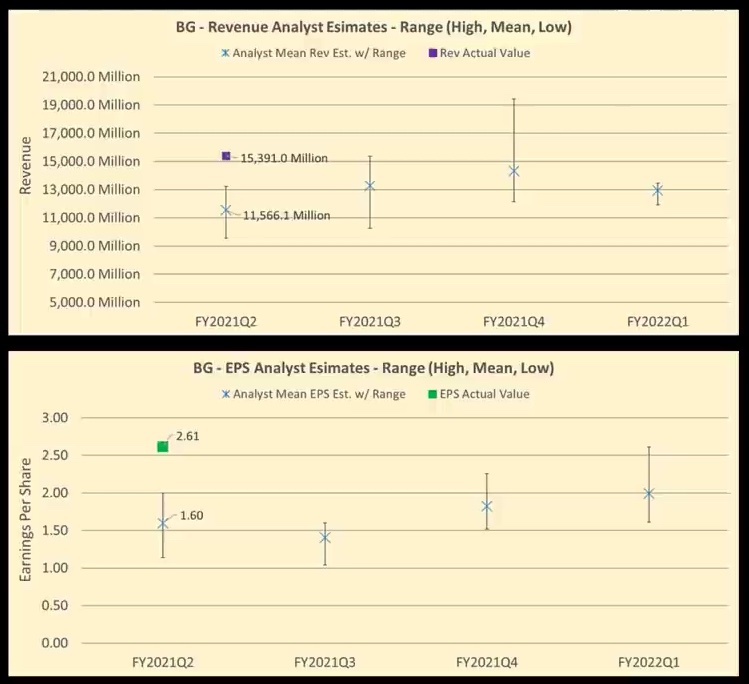

And lastly, I think that chart wise, it looks interesting. It’s basically resting just above its 200 day moving average, which I think looks like really strong support. So on that that last report, which was July the 28th, they had the trifecta, so they smashed revenue estimates, EPS estimates, and they raised their guidance. And the degree of selling here was such that they beat analysts estimates on EPS by 61%.

So they came in with 2.61 against analysts estimates of a dollar 62. They smashed revenues by 33%. So that generated revenues of 15.4 billion versus consensus estimates of 11.6. And they raised their full year 2021 adjusted income estimates to 8.50 per share from 7.50. So you can see why I think the analysts are a bit behind the curve here.

As I’ve mentioned, I’m looking for meaningful analyst upgrades to 2022 estimates. I looked through the options market. There wasn’t anything particularly that jumped out at me. So I’m simply long stock with a price target of around $95, $100 by the end of the year, they’re currently around $80. So you can do the math.

Chris Quill: Awesome. That is I think that’s a really interesting macro synopsis that you put in there as well for that stock. So Jason, Ross, thanks for that.