Chris Quill: Today I’ve got Edward Schek and Raj Malhotra joining me. And guys, looking forward to, as always, getting your take on markets and what’s happening in your own portfolios as well. And Ed, perhaps I’ll start with you this time.

Ed Shek: It’s good to be back. I’m going to talk about the stock code Global-E Online. It’s an $8.3 billion company. It’s Internet and direct marketing retail. So basically, this company simplifies direct to consumer cross-border e-commerce. So it’s effectively a software publisher whose platform integrates onto the margins, optimizing the experience for international buyers as in reality, cross-border selling is actually quite tricky.

You think of a lot of big name brands they dominate or they build that brand in the local market, and customs takes logistics. They own the market inside out. When you sell overseas, when you do sell into foreign markets, suddenly quite complicated. You’ve got to deal with local tastes. Customs as well as logistics, tariffs, tax codes, local laws.

Globally, online does all this heavy lifting. So what is the heavy lifting? While it’s still 25 languages, 100 currencies, 150 different payment processors, 20 shipping logistic companies and 200 destination markets. Okay. So it makes it seamless end to end, but it’s a bit more than that. They’ve got a great network and it’s building every day with every new market, every new client, and they’re still expanding, but they’ve leaned heavily on artificial intelligence to use that great data sets, which are of large value to any potential merchant.

What they really doing is helping a brand sell overseas by optimizing their store from on a market by market basis. So instead of saying, right, we’re just selling into Europe, you’ve now got the data and the skills to know what sells better in Scandinavia versus southern Mediterranean. Well, sometimes it’s just a function of better web design. A lot of the time it’s actually what products are selling well and how they’re being sold.

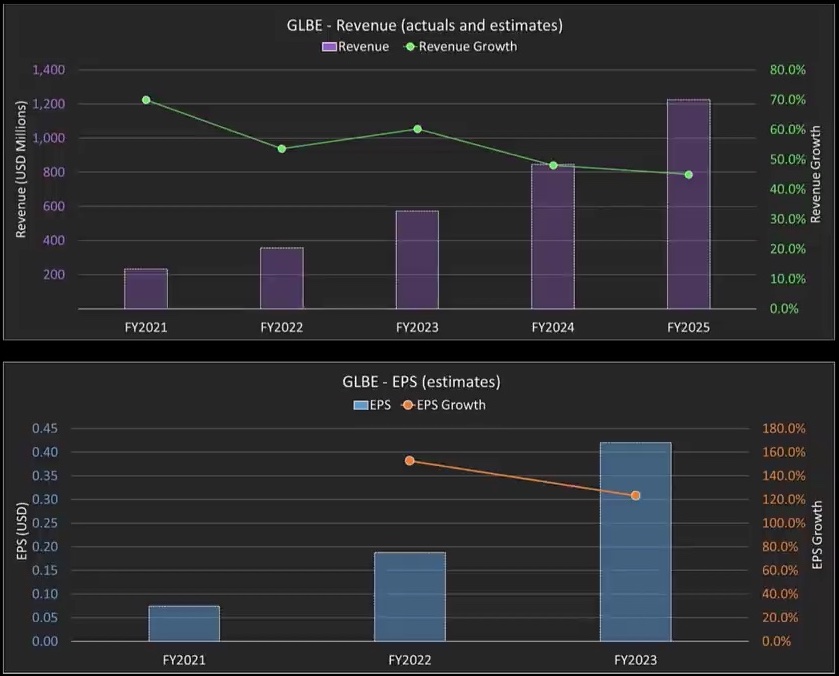

It’s a lot more than the logistics business. It’s actually driving their clients commerciality. Okay, now let’s have a quick look at the quadrants this company and it has just reported last night and we’re going to come on to that. Is this not a particularly clear cut picture? This company is going to make $0.07 this year. What does that mean?

It’s pay is it’s massive 700 degree care completely not this is not an earnings story yet. It’s a revenue story. It still holds a hefty valuation, 34 times. Sales so cheap because there is such a big price potential. Whenever I’m looking to buy or sell a stock, we look at the static quotes, but implicitly I’m buying a stock where I think the quotes that I see are wrong, meaning I think that’s a clear pathway for those earnings to get revised up.

And obviously we want operational leverage. We want the earnings soon to start really outstripping the revenue growth. So revenue growth 100% last year, 70% this year, 60% next year. The earnings is $0.07 this year, growing to $0.19 this year. So your earnings are going up 150% from a low number. It’s far exceeding revenue. You’re starting to get a pay and profit delivery service.

Now, generally a brand in that quicker will get 30% of website traffic from overseas markets, but it only delivers 5 to 10% of its total sales overseas. So there’s a big mismatch of delivery and this is one of the big opportunities, this huge addressable market now early run on earlier on in the year, this company to deal with Shopify simplifies for 1.7 million merchants.

It’s got an exclusive deal, so it’s got access to a huge new market. Now I’ve just come off the conference call or halfway through the conference call, the earnings conference call note. Every one of those 1.7 million merchants has got the quality, the size, the scale or the desire to sell globally. This company says about 2%, the largest brands on Shopify.

They’ve required the high touch globally online solution that’s 34,000 potential clients. How many do they have at the moment? 522. So they’re now plugged in to potentially 34,000 potential clients off a base of 500 huge upside. Forrester Research reckons cross-border e-commerce will be $700 billion, even with this reopening 2.0. And that’s happening in front of our eyes potentially.

That’s 35% compound growth year on year for the next two years. Now, when you look at their numbers, gross merchandise values are 86%. Year on year revenue is up 77% year profit. This is from last last night’s earnings up 127%. So we’re starting to see that leverage. Their margins this quarter last year was 30%. They were 36%. In the summer, they’re now 38.2.

Why is that margin expanding? They’re getting scale they’ve invested in will continue to invest in this great global one stop shop international selling machine. Every time every sale increases, the value of the data they have. And this is a virtuous fading cycle. Okay. So they’ve also got scale with new verticals. This company obviously started off selling apparel, accessories, you know, brands that you probably own or aware of.

It’s now signed up its first big consumer electronics. This is also what I like, scalability. You have got a valuable network. You’re selling this product. Why can’t you just sell others so you’re constantly opening up new markets. Now take listen some catalysts. So a number of merchants customers there’s clearly a pathway to really change the basis could have a couple of thousand in a couple of years I don’t see why not gross retention, 98%.

Only about two out of every hundred clients give positive feedback, indicating high satisfaction with the product. This suggests the company likely offers top-notch products with strong customer loyalty, which translates to the ability to set higher prices over time as relationships with clients deepen and extend over years.

Initially, acquiring customers can be expensive, especially for a company that is not yet profitable. However, as time goes on and the initial costs are spread out over a longer period, revenue growth becomes the primary focus. Key performance indicators, such as net retention rate, become crucial metrics to track.

The net retention rate, at 140%, indicates that on average, clients are spending $1.40 this year compared to $81 last year. This demonstrates not only customer loyalty but also a consistent increase in revenue per customer annually. With a sizable market and potential for acquiring new customers, the company’s prospects are promising.

Despite a strong performance initially, including an IPO that saw the stock rise to $80, subsequent events like an IPO lockup expiration led to a decline in stock price to $52. This decline can be attributed in part to market dynamics, including shifts away from e-commerce stocks towards sectors reopening after COVID-19.

However, despite short-term fluctuations, I believe the current stock price presents a good entry point. With significant operational leverage and growth potential, I foresee the stock potentially doubling or even tripling in value over the coming months or years.

To capitalize on this opportunity, I’ve purchased call options and sold stock options, leveraging my belief in the company’s long-term potential. While short-term factors like market fluctuations and inflation may pose challenges, I remain confident in the company’s ability to improve its financial performance.

Recent financial updates indicate an acceleration in revenue growth, with forecasts for the fourth quarter revised upwards. Despite potential risks such as a general economic slowdown or supply chain disruptions, I believe the company is well-positioned to weather these challenges and continue its growth trajectory.

In conclusion, while there are risks associated with investing in the company, including market volatility and potential supply chain disruptions, I believe its strong fundamentals and growth prospects outweigh these concerns. Therefore, I am optimistic about its long-term performance and have committed to holding my positions in the company’s stock.

Chris: Yeah, that sounds like a really interesting one with with a lot of upside, like you said and great that you kind of pointed out all of all of those risks as well in the in the near term, especially. Raj, we go over to you. What have you been looking at?

Raj: Great to see you both! The market seems cautiously optimistic now, especially as things are getting back to normal. One company I’m interested in is Lending Club, which underwent changes in 2020, becoming a bank holding company after acquiring Radius Bank. They’ve shifted from being solely peer-to-peer lenders to a hybrid model, combining digital lending with traditional banking. I think this flexibility positions them well to navigate future challenges. Despite a 300% increase in stock value, I see further potential if they grow their loan book and operating income as projected.

Lending Club had impressive results recently, surpassing expectations in earnings and revenue. They even raised their guidance for the next quarter. What’s particularly impressive is their consistent outperformance, even after raising expectations.

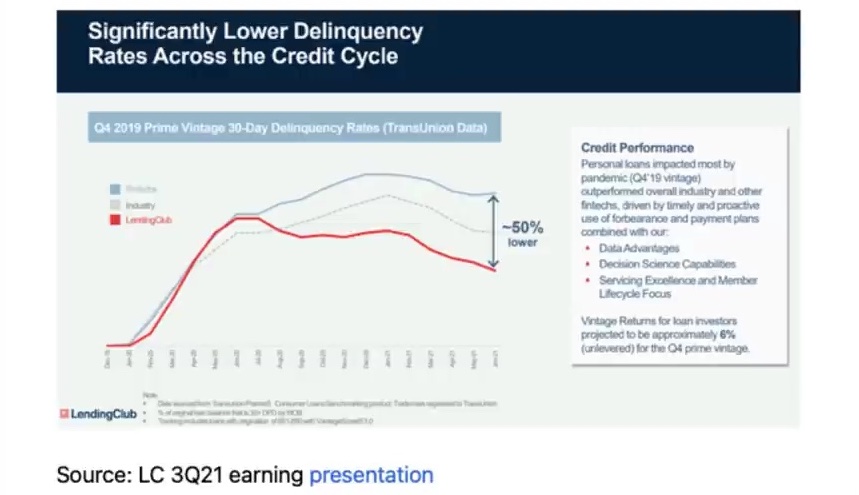

Lending Club has been a pioneer in using alternative data for loan decisions, which sets them apart from traditional lenders. They’ve become a major player in the unsecured consumer loan market. They now retain a portion of their loans while selling the rest to institutional clients. This model, along with their digital platform, covers their expenses and drives profit.

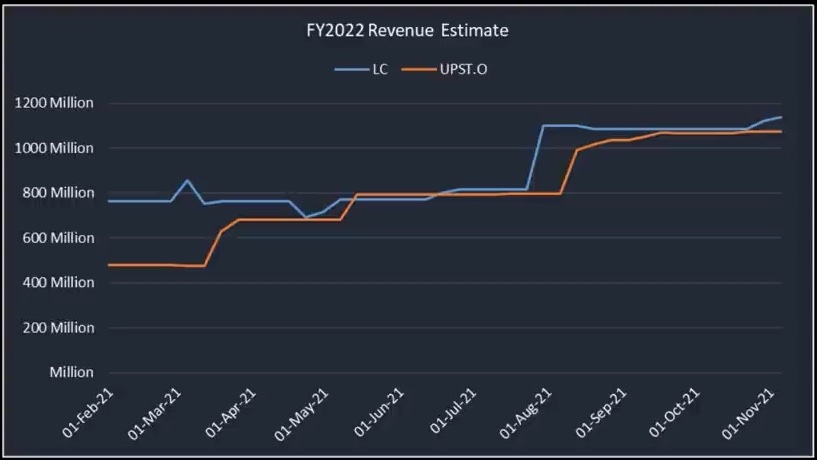

Their interest rates might seem high, but their low default rates tell a different story. They’ve been conservative with loan provisions, which could further boost investor confidence once recognized. Comparing them to Upstart, Lending Club appears undervalued despite comparable revenues.

What I like about their business model is they offer loans, not just selling them and fees to banks like Upstart does. This could squeeze margins a bit for Lending Club, but they still have high-margin loans, giving them flexibility.

Additionally, their digital platform, using technology, is an area many companies can compete in. Currently, Lending Club holds about 12-13% market share, with room to grow.

They’re exploring auto loan refinancing and expansion, which aren’t factored into valuation metrics yet. Also, buy now pay later isn’t factored in, but could boost the stock if they announce it.

Regarding my trading strategy, I adjusted my position after earnings. It’s crucial to reassess your position regardless of winning or losing. I structured a different trade post-earnings, focusing on a 3:1 risk-reward ratio.

This trade offers good risk-reward considering the macro environment, which is a bit uncertain, though cautiously bullish.

Chris: Cool. Yeah, I like I like that one as well. Ed, let’s go back to you. Was there any other stock ideas you were looking at.

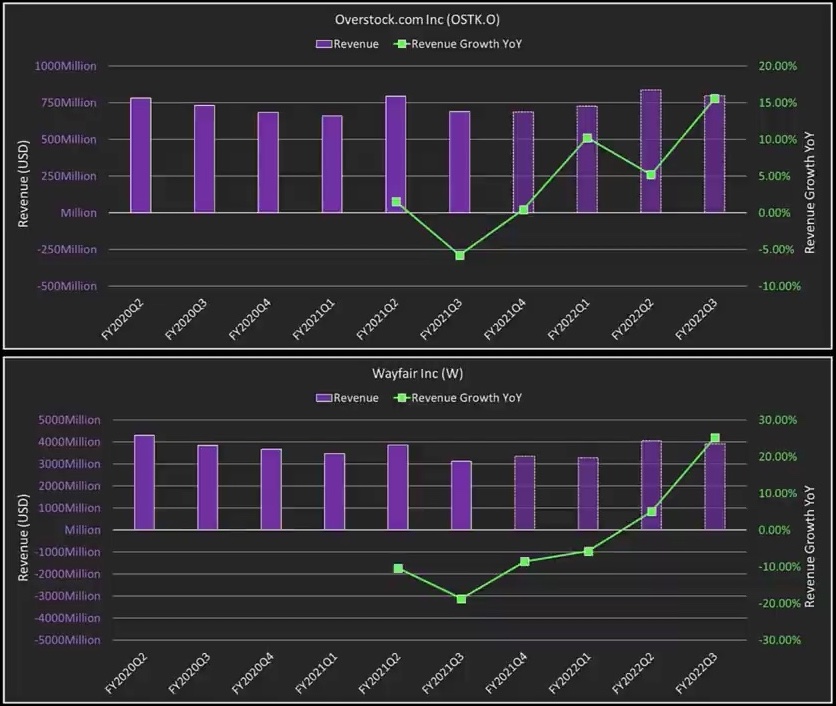

Ed: I’m focused on Overstock and Wayfair’s recent earnings. Overstock’s stock rose by 25%, but there’s anticipation for more. Both companies experienced a decline in sales during the weakest quarter for online furniture. Overstock is valued at around $4.5 billion and Wayfair at about 25% more. Overstock is adapting well to market changes, while Wayfair is facing challenges against competitors like Amazon.

Overstock’s CEO mentioned their business model, emphasizing their diverse range of sellers and efficient distribution. Despite being the fourth in home furnishings, Overstock is gaining traction. To compete, Wayfair needs to invest more in pricing and advertising. Overstock’s valuation is currently lower than Wayfair’s, despite its potential.

Overstock’s non-furniture ventures, like blockchain and crypto trading, hold significant value. Nigeria’s recent digital currency initiative highlights the potential of such technologies in developing markets. Overstock’s involvement in digital transactions and other emerging fields could significantly boost its value.

Potential positive developments in Overstock’s non-furniture ventures could drive its stock higher. Despite uncertainties, Overstock offers valuable opportunities beyond furniture sales. Adjustments have been made to investment strategies to accommodate potential market shifts.

Investment strategies have been adjusted to reflect potential market changes and capitalize on Overstock’s potential beyond furniture sales.

Chris: So with that’s for equity ideas we’ve kind of talked through, right? I don’t know if you want to add to that or whether you’ve got any markets or macro you were thinking about.

Raj: So, I often discuss fintech and tech stocks, but I won’t get into that today. What I want to talk about is the term “stagflation,” which Wall Street folks bring up every 5 to 10 years as a risk.

We haven’t seen it much since the seventies, but Google searches for stagflation have been high since 2008. Also, a recent survey showed that fund managers expect stagflation more than they have in years, which worries many.

Stagflation means high inflation and slow growth, which historically brings down stock market returns by over 2%. This stands in contrast to normal times when returns are up around 2.5%.

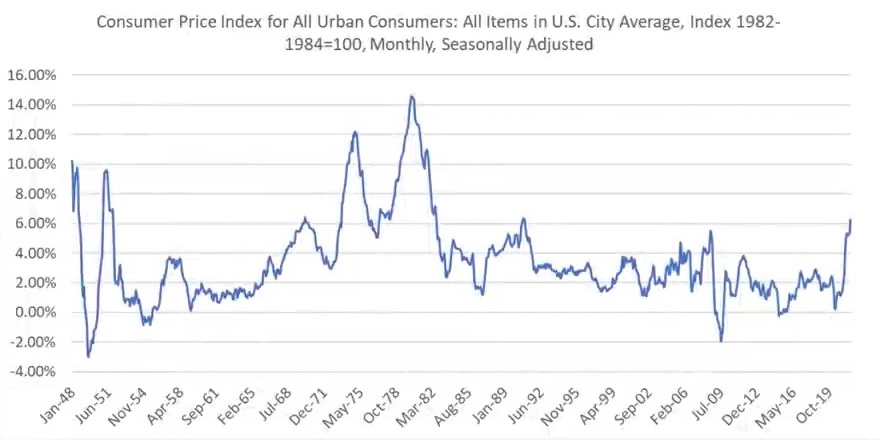

So, there’s a big difference between stagflation and non-stagflation periods. Despite this, I don’t think stagflation is very likely yet. But we should keep an eye on certain data points. For example, the latest Consumer Price Index (CPI) shows inflation over 6%, the highest in a while. Also, GDP growth is expected to slow down in the third quarter compared to the second quarter.

However, I’m not convinced stagflation is imminent. One reason is wage inflation, which is real because there’s a shortage of workers. Unlike the seventies, unemployment isn’t sky-high. Also, our current situation is very different from the seventies.

In the seventies, high inflation was partly due to price controls, which restricted supply. But now, supply isn’t constrained; it’s just delayed due to issues like supply chain disruptions.

Even though some companies are facing supply chain problems, it’s not as dire as it may seem. If we’re still in this situation in 9 to 12 months, with high inflation persisting and growth staying sluggish, then stagflation could become a real concern. But for now, it’s just something to keep an eye on.

Chris Quill: Fantastic contributions from you both, as always today. And thanks for taking the time out of your busy schedules to be on the show once again.