Chris Quill: My esteemed guests this week are Ross Williams and Jason McDonald. They both come armed with a wide array of market knowledge. So we’re in a really beneficial position today to be able to listen to them.

Ross Williams: So as per normal, one long idea, one short idea. People who are involved in this sector, they may have come across what I would describe as a fairly low quality rumor last week about Google taking a look at Pinterest for an acquisition.

I’m not going to comment on the veracity of that rumor, but what I will say was I heard it from three separate sources that kind of got me thinking a little bit. And I thought, well, you know what? Let’s not just dismiss this. Let’s do a bit of work on the company and work out whether there’s something to this or not.

So what is Pinterest do? Pinterest describes itself as a visual discovery engine. And what that means is that it’s images which people click on and I click through to do to do shopping on it. It’s a very female oriented platform.

It looks like they’re going to shoot for about 6.5% revenue growth, which is like 35% EPS growth, which I think is much better. This time last year the stock was trading well over $80.

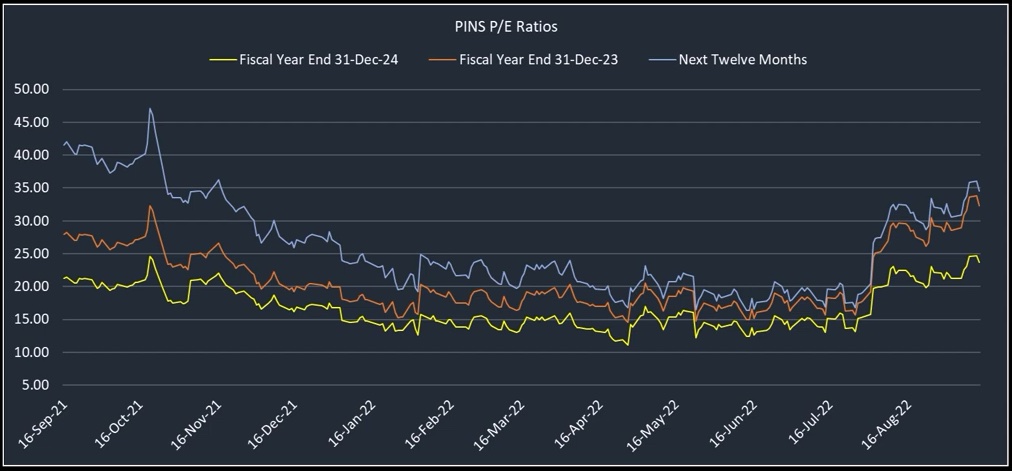

It’s now at $24 and it’s been clearly caught up in the tech and the consumer related sell off. We’ve seen this year that the valuation doesn’t actually seem to that 32 times December 23 and 23 times December 24 earnings now that if you believe the 35% EPS growth even without the takeover rumors, it doesn’t strike me as the worst thing in the world.

So from a purely financial investor person who trades in the stock market, is that valuation going to make people go, well, I’ve got to buy this thing? Probably not. But I think what we’ve seen, particularly in the last cycle, is that if somebody in the same industry were to acquire it, they could extract a lot more value out of the acquisition, which means that those earnings estimates don’t really mean too much for them.

Now, is this thing a strategic fit for Google? Google integrating this business into it, fit into its search program. I mean, that just seems like the most obvious thing in the world, but it’s so obvious that everyone knows it. So you could probably make a case that you’ve got a couple of rumors going around and you’ve got the valuation which kind of looks okay. So the way I feel about how to structure this, what kind of a premium would someone pay for, quite honestly, I don’t know.

I’m going to say it’s more north of 20%, but more than that, I don’t know because I don’t know how sticky the register is. What is the potential timeframe for takeover? I don’t know. But in my experience, it’s normally longer than people think, particularly in this environment where companies are feeling the need to open their wallets and snap up competitors.

So I just to buy the stock potentially on a leverage basis for CFD: short the Triple Q ETF against it. So I want to keep it totally market neutral. If the market has another sell off like we’ve had in the last week, well, this is probably going to go down as well, but I guess it’ll go down less than the market.

This thing has been outperforming the market for a couple of weeks now. But with a perfectly market hedged position like that with a couple of things going on for it, probably don’t need to worry too much about that either. So that’s my that’s my long idea.

Chris Quill: Good stuff. Jason, let’s go over to you. What have you been thinking about?

Jason McDonald: The company is called Hermes International, so obviously it’s a European company, French company. All of the people have heard of it.

As long as it’s nowhere obscure, I would always advise people to go where the liquidity is and of course that that is going to be on the Euronext listing.

Hermes have a market cap €138 billion. However, two thirds of it is owned by the family. And so the free float equates to about €46 billion, which is still obviously fairly hefty. And the current share prices around this is quite expensive. Share price is set around 1300 euros per share. I think we all understand what Hermes does.

So, luxury goods brand. Last year, in terms of the revenue breakdowns the majority saw 46% of revenues is in what they call leather goods. And then we’ve got 25% of revenues in ready to wear and accessories. Then you got 7% in silk and textiles, 4% perfume and beauty, 4% watches. And then the rest of it equates to about 14% in terms of the geographical breakdown sales to Asia, excluding Japan last year, 47% next.

Biggest geography for them was the Americas, 16%. Europe excluding France 15%, Japan 11%, France 9%. And the rest about 2%. As I say, the family owns about two thirds of the shares. LVMH tried to take them over back in 2010, a failed takeover attempt. So takeovers seem to be a theme on today’s show. The five members basically agreed that they would retain control until at least 2031.

So we don’t have that risk hanging over the company unless, of course, they go back on their word, which is not unheard of for French people. So we’ve got last year’s EPS €23.30 this year, €28.12, and next year, 31 €31, $0.12. So we’re looking at essentially predicted earnings growth among the analyst community of 21% for this year, 11% for next year.

We’ve got a fairly rich valuation there, 47x PE for this year and 42x PE for next year. They have a miserly dividend yield of 0.61%. And compared to the sectors, the sector is actually growing basically the same 20% this year, 10% next year. But a much lower PE ratio on average around 29x for the sector compared to 47x.

As I said, for Hermes for this year and for next year, the is on about 26x versus 42x for Hermes. So basically they’ve got almost identical growth characteristics, but of course a very large PE multiple premium compared to the likes of LVMH, Kering, which owns Gucci, Balenciaga, etc..

So where’s the idea from? Okay, so first off, they had a great first half. They generated 20% revenue growth and a 42% operating margin, which is the largest in the history. My question here is: have we seen the peak in those margins? Secondly, if we look at what’s going on in various pockets of the kind of luxury goods market we have, believe it or not, we’ve got people that compile indices on things like luxury watches.

So at the end of last week, a company called WatchCharts.com pointed out that with respect to their index of 30 frequently traded luxury watches that’s the overall level of the index closed in the last week at 17,686, which is down 23% from the peak, which was in March. And that index is still at that level almost double its pre-pandemic level, and if you’re in the Rolex submariner market and you’re long, then you’re feeling it because apparently prices are down 46% since March for a Rolex Submariner, according to Bain Capital.

China’s obviously the second largest luxury goods market there, 21% of global luxury demand. They will be the largest luxury goods consumer by 2025. And I noticed that in an interview in the F.T., James Wang, who is a luxury watch reseller in Nanjing, told the F.T. that the boom time is over.

We are entering a correction period that could last for a long time. That was backed up by the CEO of the China Market Research Group, who I’m speaking about. Chinese consumption said that it’s probably the weakest I’ve seen in my 25 years in China. So that’s what’s happening in China. I think we know quite a lot about what’s been happening there.

We’ve obviously got the Zero-Covid policy that they’re still trying to enact. So you’ve got mass lockdowns, which are obviously a problem if you’re trying to sell anything, but particularly if you’re a luxury vendor.

Another point which is relevant is that because of what’s been going on with stock markets, stock based, executive compensation has obviously dropped quite a bit. In terms of Hermes, their last report was for the half year on July 29th, their operating margins came in at a record 42%.

They beat on both EPS on revenues. Stock price has rallied about 7% since then and essentially trod waters since July 29th. And my question really here is, is that party over now? What could be the catalysts? I’d be looking for strong EPS downgrades for next year. We’ve got a data point coming up in October with the Q3 sales on October the 20th.

We’ve got the share price around the 12 month consensus price target. Now that’s not that significant, but it’s just kind of an eye for an eye in terms of the recommendations. We got nine buys, strong buys, 11 holds, 93 sell. So there’s scope here for downgrades both in terms of estimates and recommendations. In terms of the trade structure, my target is €1,000.

It’s around 1300 at the moment. So in terms of the options, you really got to go to the European exchange. And the structure that I found, which is which is pretty attractive and gives you quite a long time as well for the trade to go right, the March 2023 Vertical Put structure.

So going Long the the 1200 Euro strike for March 2023, you can buy those around €76 and selling the the 1000 strike for €33. Obviously that’s a net spend of €43. You break even around 1157, which is about 10% below where we are. So you’re you’re putting on a structure that’s 10% out of the money at the moment. And if the stock price does go to €1,000, you’ve got over three and a half times risk reward.

Chris Quill: that sounds like a good one. Thank you for your wise words this week. We’re going to leave it there. As always, fantastic insights from you guys both in terms of market outlook and idea generation.