Chris Quill: Today I’m joined by Raj Malhotra and Ben Berggreen. Let’s get stuck into it in terms of ideas for portfolios. Ben, let’s kick it off with you today.

Ben Berggreen: Hi, guys. Good morning. From the West Coast here. I have two ideas I want to talk about. These are both macro driven, because this environment is very macro oriented. But before I get into the real company specifics, let’s just have a look at the current drivers of the market these days.

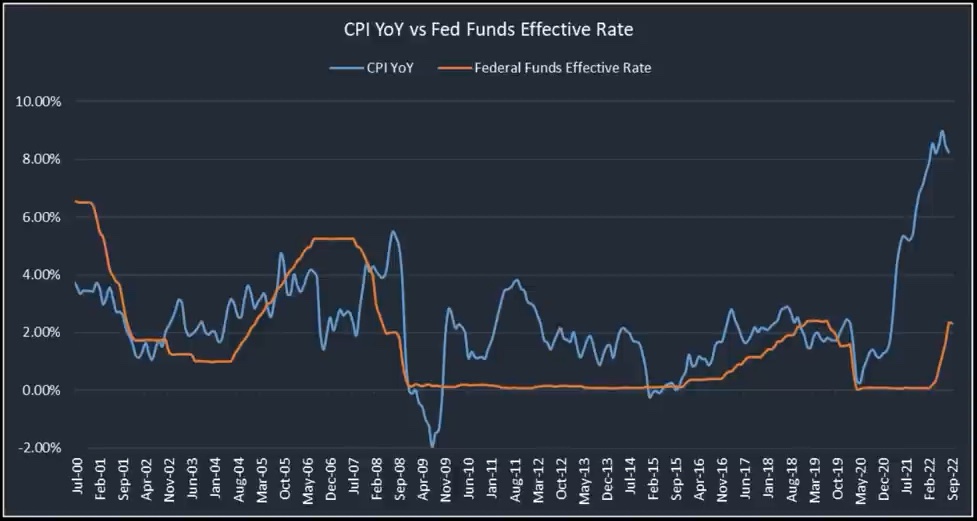

It’s clearly the inflation problem we’re having. It’s obviously not a secret that the Fed has been really cranking the rates higher and they basically have the emergency brakes on to try to get this under control. So the rates are at a vicious pace being raised higher.

The latest CPI reading wasn’t too bad, sitting at 8.3% in August. But in June, it spiked over 9%, the highest in 40 years. This turmoil is causing chaos in the markets, especially for high-growth sectors. So, we’ll see how things play out.

Looking closer at the CPI data, food and energy are the major movers, with cereal and bakery products seeing a whopping 16% increase year over year, double the headline number. This data sets the stage for my first trade idea.

Digging into the food manufacturing sector, we’re not just focusing on cereal alone. We’re sorting by fiscal year PPI from high to low, aiming for stocks with high PE ratios, indicating strong growth expectations. Post stands out here, showing promising revenue and earnings growth.

Post Holdings, a $5.2 billion breakfast cereal company, has been making strides. Their earnings per share outlook for the next four quarters is on a positive trajectory, with recent announcements of a $300 million buyback program. They’ve been steadily growing, with a solid balance sheet and manageable debt.

Technically speaking, the stock is on an uptrend, breaking out of previous levels. This is notable, given the market’s overall downward trend this year.

Typically, stocks like this might hit a plateau for a while. Considering this, we’ll factor in potential congestion phases. But with the momentum in earnings and improvements, seeing the stock at $100 or above by year-end isn’t far-fetched.

I’m eyeing an options strategy here, specifically a calendar call spread. While not the most liquid options, they’re manageable. Buying December 85 strike calls and selling October 90 strike calls seems like a good play.

The total cost for this trade would be $2,415. If the stock stays below $90 by October expiration, we keep the credit, reducing the overall cost. If it reaches $100 by December, the payoff could be significant, providing a favorable risk-reward ratio.

Now, considering the uncertain market conditions, I’m also looking into a complementary short play, which we’ll discuss later. But this idea stands strong on its own.

Chris: Cool. Good stuff. Well, with that being said, Raj, let’s let’s go there over to you and see what you’ve been thinking about.

Raj: Hey, everyone, let’s dive into this. There’s a bunch of stocks out there that seem really cheap, especially in the retail sector. Recently, there was a surprising upgrade on Home Builders, which is a bit against the crowd. It suggests there’s hidden value in some of these stocks.

But here’s the thing, just because something looks cheap doesn’t mean it’s gonna bounce back soon. Things could keep getting cheaper. I’m more interested in companies where you can see the effects of inflation, or ones that have tangible products people are still buying. There are some retail stocks that seem like bargains, but I’m cautious about investing big until I see clearer signs of potential growth.

One stock I’m eyeing as a short is Wayfair, ticker symbol W. It’s an e-commerce company selling furniture and home goods online. It did well during the pandemic, but now it’s down over 80% from its peak. The upcoming earnings report on November 3rd is expected to show even bigger losses.

Looking at the numbers, Wayfair’s revenue is dropping, and its losses are growing. They’re facing challenges from all sides, especially with bulky items, which aren’t ideal in the current market. Plus, they’re losing customers to other online furniture stores and even brick-and-mortar ones.

Their financial situation isn’t great either. They’ve got negative cash flow, negative book value, and a lot of debt. They’ve already started laying off employees, but they’ll probably need to do more to survive.

One potential lifeline for them could be shifting their business model to act more like a third-party marketplace, similar to eBay. But it’s a big change, and it’s unclear if they’re fully committed to it.

Their current structure is unsustainable, especially when you compare it to eBay’s business model. So unless there’s a major overhaul, I don’t see things turning around for Wayfair anytime soon.

I’ve recently restructured my trades on Wayfair, betting against its stock. I’ve bought some put options and sold others, aiming to profit if the stock continues to decline after earnings.

So yeah, that’s where I stand on Wayfair.

Chris: Ben, you mentioned you’ve got a paring to your initial Post idea, so should we talk about that?

Ben: Yeah, I can do that. I want to touch on the big picture. My long idea was based on CPI inflation. This one is similar but based on different data, still leading to a macro catalyst. These are both style-based ideas.

Looking at the latest PMI report, it’s insightful. The headline number shows expansion, but the trend has been downward since late 2021. In August, seven industries saw contraction compared to July, mostly linked to construction and building. This backs up Ross’s point about the furniture space contracting.

New home sales data also supports the idea of a cooling housing market, especially with higher mortgage rates. While there might be long-term value in housing stocks, we’re focused on short-term options trading and following the trend.

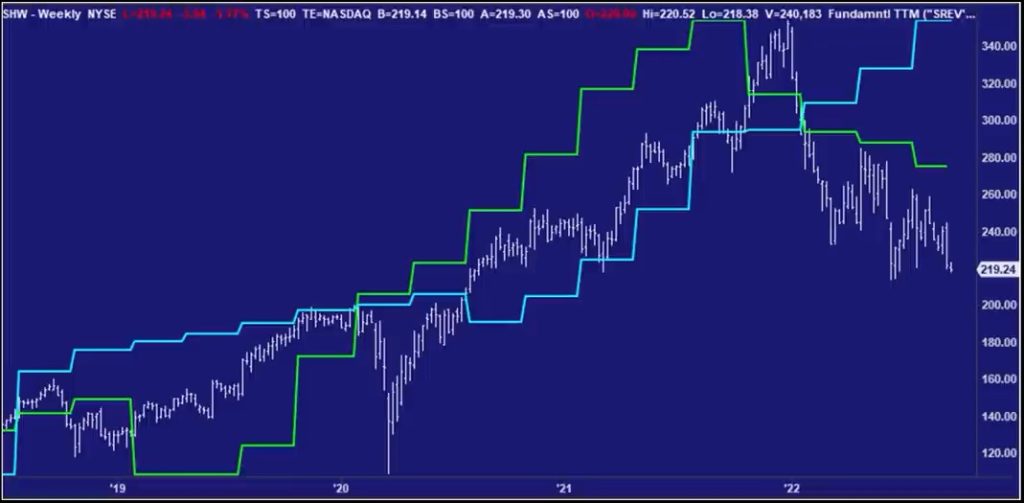

So, I looked into the house paints space using quantitative filtering. I found four stocks with negative forward revisions in earnings and revenue estimates, a warning sign. Among them, WPPG stood out with significant cuts in growth estimates.

Before diving deep into fundamentals, I checked options liquidity. W had the most interest, so I’ll focus on that. Now, onto Williams. It’s a large company with recent earnings below expectations, guidance cuts, and supply chain issues, especially in chemicals.

We’re not holding stocks for decades like Warren Buffett. We’re after short-term gains, so I’m focusing on the consensus earnings per share revisions trend. Unlike WPPG, SSW has seen downward revisions across the board.

Looking at SSW’s chart, revenue has been climbing, but earnings peaked a while ago, and the stock has been falling since. Margins are getting squeezed due to rising supply costs. Basic price action shows a downturn.

For options trading, I’m pairing SSW with P, similar to the structure I used with Post. This gives an open-ended profit potential if the market takes a dive, especially after today’s Fed news.

These trade ideas can stand alone or together, considering the current market situation. So, that wraps up my short ideas.

Chris: Yeah, definitely a good point. On kind of staying agnostic in the portfolio at the moment. That’s something we always talk about on here is having a balance of being long and short in any in any environment.