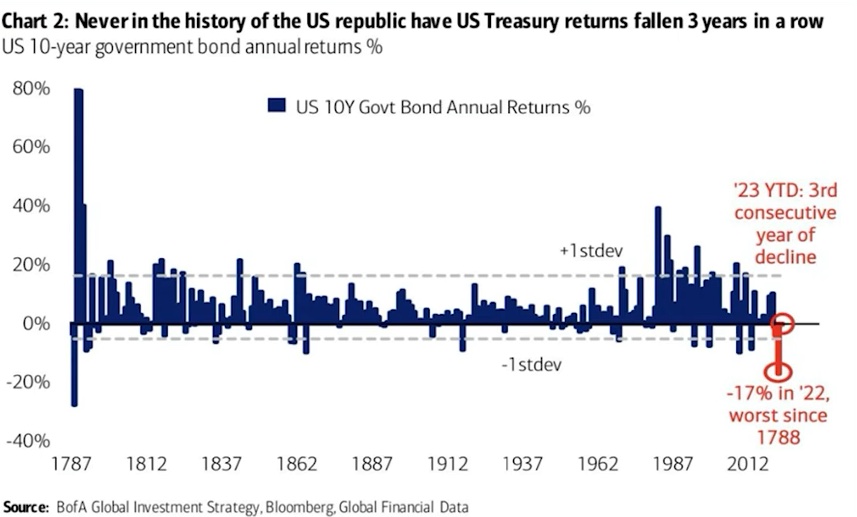

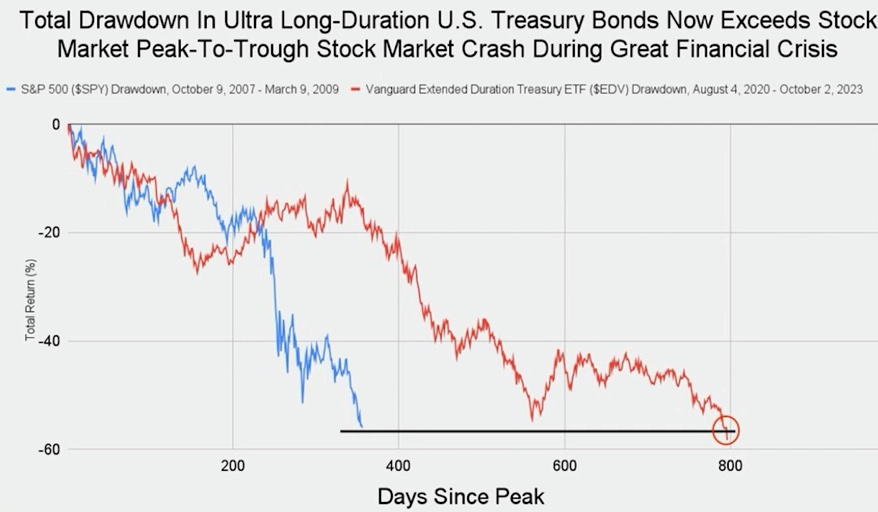

What’s happening in the market today is quite unique. Let’s discuss how things are a bit different, what’s similar, the risks ahead, and how we can navigate through it. Looking at the chart, this bond market sell-off is unprecedented. It’s the first time in history we’ve had three consecutive down years. This is especially tough for bond holders. The drawdown on ultra-long duration bonds now exceeds that of equities during the GFC.

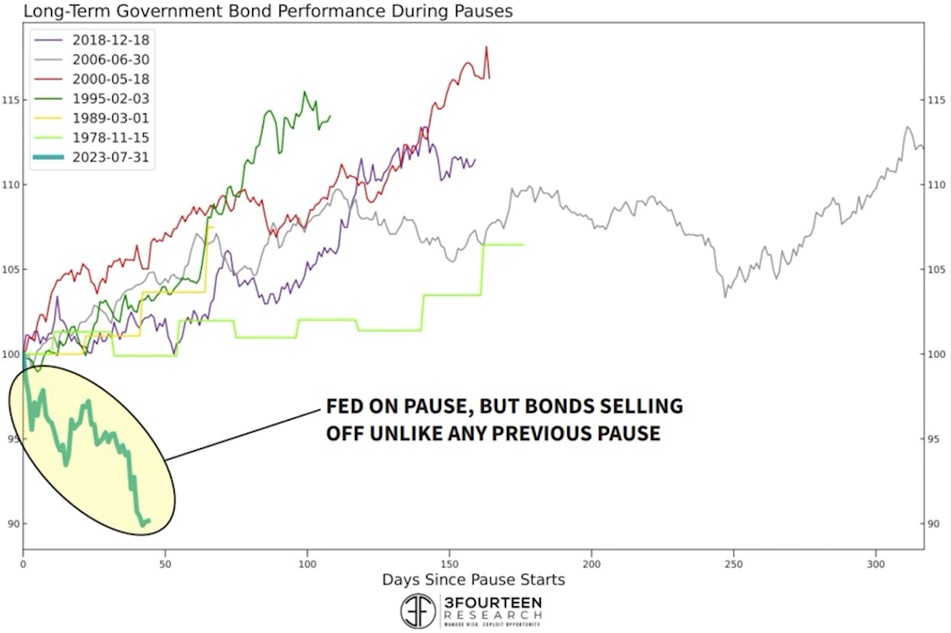

Historically, when the Fed pauses, we see yields go down. But this time, yields are spiking, which is unusual. There could be various reasons for this, including the possibility that the Fed might continue raising rates, leading to a hard landing. But I believe this outcome is probably inevitable.

Why are we talking about the bond market now? Well, it’s a classic case of more sellers than buyers. The US government needs to issue bonds to cover its huge fiscal spending, but buyers like the US Federal Reserve, China, Saudis, and Japan are less active than before. This creates a situation where yields must rise for supply to meet demand.

Another factor is excessive fiscal spending. The US government’s current situation adds to market uncertainty, which markets don’t appreciate. Until there’s clarity, we can expect elevated volatility in the bond market. Essentially, the market is telling the government to rein in spending.

Lastly, the Fed’s actions play a significant role. The narrative of “higher for longer” may not hold true. We might see rates rise sooner than expected, which isn’t favorable for equity markets in the long run.

Now, why is all of this pretty negative for equity markets? The first thing is the Fed rules the roost. Think of Jay Powell as you would Tony Soprano. He’s the boss. And what he says goes. So until he eases monetary conditions, we’re going to find that a hard landing is on the horizon some way, whether it’s three months, six months, 12 months, but it’s on the horizon.

Tight financial conditions and tight lending conditions have historically always led to a recession and a hard landing. This is not a plan that the Fed has ever been able to land a crash landing to the tarmac pretty hard. So as you can see on these charts, the lending conditions remain very tight. There’s no reason why there’s going to be a soft landing this time around.

And if you saw Ed’s presentation last week, he would have talked about the first domino to fall. Three dominoes, you know, lined up, ready to go. The consumer is now starting to be under a little bit of pressure. We saw that again today. Oil prices down dramatically. Why were they down? Because consumer demand is falling off. The consumer is facing increased pricing pressure at the petrol pump, demanding drop, demands dropped and inventories going up.

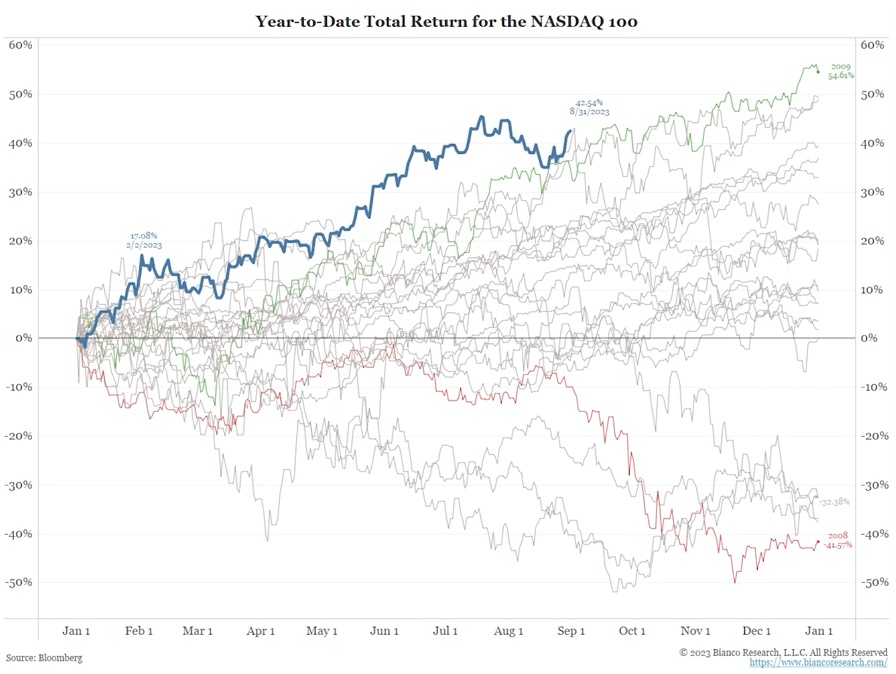

Signs of slowing consumer demand. Reiterating Ed’s view on this domino falling. Now, soft landing has been the narrative for most of the year, and this is still very much a sign, sign a different situation. Firstly, we’ve got the Nasdaq up year to date. Record levels never been seen at these levels before. So understandably, people are getting pretty excited.

GDP, pretty strong. Unemployment, barely a tick. So all those things that any spoke about last week in place, that’s why people think soft landing. Here we go. Now, there’s many things that precede a hard landing. One of the key things that precedes a hard landing is the media and retail focus on the likely outcome of a soft landing.

So is a range of things just to highlight that for you. Firstly, Wall Street Journal articles spike prior to recessions Journal articles about soft landings. So to go to Google searches and retail traders getting in there looking at soft landing, what does it mean? All that sort of stuff. That same, same, but different. It happens every time. So you can say, here is a montage of soft landing headlines from every recession in the past, preceding every recession.

This time is not going to be any different. And today, perhaps we saw the first couple of changes in this narrative coming through with the talk of missing out, the soft landing, a potential hard landing to come. So what do we do here? Firstly, we’re going to have very volatile times. What’s coming up is down days. Trying to do something on a short term basis is going to be really hard.

So what I would be looking at would be a continuation of what we preach at the Institute is a diversified portfolio of uncorrelated trades. Secondly, the downside, it’s got a long way to go in a hard landing scenario. Consumer discretionary is down a little bit. But as you can see from this chart, it’s still up year to date and would have a long way to fall.

The third point, be looking at strategy and some ideas. That is getting insurance in both directions. Now, with insurance in general, we do not want to be collecting it. It’s like house insurance. You don’t want to collect it. It means your house is burnt down. You don’t want to collect on things that live trades, which might be long, very high base take out of the money that might pay off in the options market or out of the money short consumer discretionary or short loss making tech.

I mean, we’ve had a massive move in one direction. That’s really tricky. But you want to have that insurance there. The final thing to think about would be a main reversion trade. Like this chart here, which would be short for Nasdaq long tail take. Now, it’s important to note that that gap is likely to close, but be careful.

It might get worse before it gets better. So there we have it. That’s what’s going on with the bond market. You’ve got to watch out below. Hard landing is on the agenda, whether it’s two months, three months, six months.

The signs are starting to come through. And our friend Jay Powell, well, he’s going to break something and it’s likely to be the equity market to some degree as well.