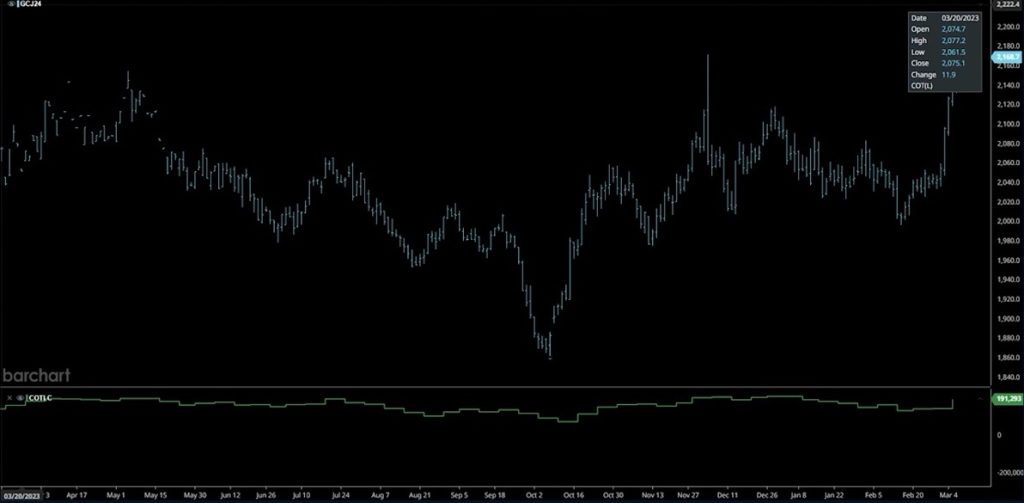

Let’s take a look at gold futures. They’ve been stuck in a range for years, but recently, there’s been some movement. Gold went up around 5% yesterday and is close to 10% above the $2000 support level it hit. This could signal a breakout, but we need to see it go past $2100 to confirm.

Gold is often seen as an inflation hedge, but that’s not entirely true. It’s actually more tied to the US dollar because it’s priced in dollars. When the dollar weakens, foreign buyers get interested in gold, which drives up the price. So, surprisingly, gold doesn’t always move in sync with inflation, especially in the short term.

And you can see that pretty clearly on this ten year chart of the US inflation rate versus gold prices. Now there’s also that geopolitical tension which is not really getting any better, especially in Europe with Russia just kind of doubling down and it does not look like that’s anytime soon. So when there is major potential for major geopolitical problems or does anything that’s pretty radical that can happen people want to buy gold is going to be a safe haven.

The recent rally in Bitcoin shows people’s continued interest in gold. However, there’s another factor at play here. The Dow and S&P 500 are currently at high valuations, with many big-name stocks reaching record levels. While this isn’t inherently bad, the prices are quite high.

These high valuations are starting to indicate institutional investors are selling off, which often leads to money exiting the market. There’s a rotation happening, with funds moving from expensive assets to other areas of the market. Currently, the forward PE ratio for the S&P is around 20, higher than the average of 15 or 16, so investors are seeking better value. This doesn’t mean a crash is imminent, but we’re seeing some sideways movement, with any rallies being met with selling pressure due to the lack of rotation into other assets like gold.

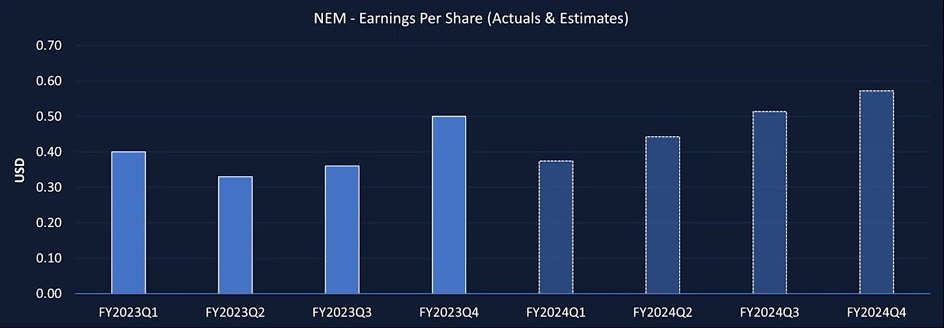

One example worth considering is Newmont Mining, the world’s largest gold mining company. They also deal in other metals like copper and silver. Price movements in precious metals, especially gold, directly impact their profits. Newmont’s fundamentals, including low valuations and a 4.3% dividend yield, make it an intriguing prospect. Their recent earnings report beat expectations, suggesting potential for an upside surprise in future earnings.

To capitalize on this, one strategy could be a diagonal option spread on Newmont Mining. This is just one approach among many, including basic ETFs, to benefit from potential market movements.

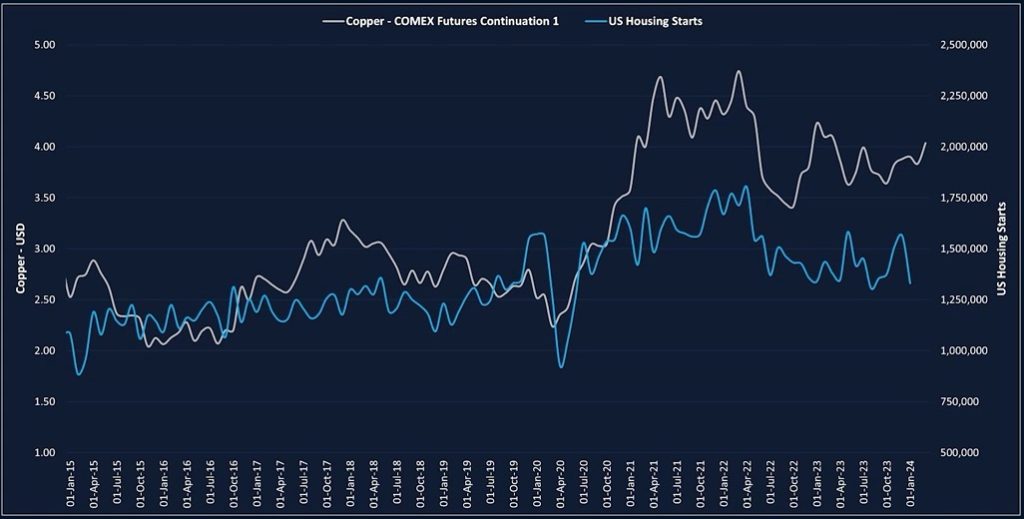

Now, let’s shift focus to copper. As an industrial metal used in various applications, including electronics and construction, copper’s demand is closely tied to economic activity. With the U.S. economy holding steady and mortgage rates dropping, there’s potential for increased demand, particularly in the housing sector. Additionally, the shift towards electric vehicles increases the need for copper in electronic applications.

As long as copper maintains its price above $4 per pound, there are opportunities worth exploring. These are just a couple of examples of how traders can capitalize on current market trends, but it’s crucial to stay vigilant for further developments.