What is the ‘Professional Trading Masterclass’ course? (PTM)

Why Did I Do It?

Is it actually worth the money?

The EXAM! (Why take it? How to prepare?)

What is the PTM?

The ‘Professional Trading Masterclass’ course is a video series that seems to be ITPM’s core offering. It’s an updated version of their original, with double the content and added material. It aims to give anyone – regardless of financial background – everything they need to begin trading on a professional level.

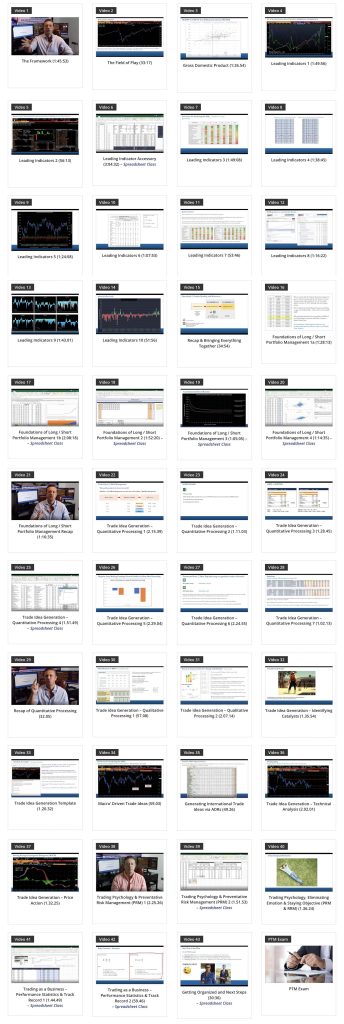

The first thing to say about this course is that it’s a MONSTER. 43 videos, some informational, some with exercises, and many of them run over 2 hours. Check out the course content:

On the website, you’ll see 2 options – you can get the 1 month access, or the 12 month access.

I don’t know why the 1 month access exists. It’s an INSANE amount of information to digest in 1 month, especially if you have a full time job and other commitments. I was definitely tempted to get the 1 month, but if you want to pass the exam (which I’ll talk about later), you’ll be wasting your money.

What do you actually learn?

Whether you’re totally new to trading or you’ve been doing what you think is trading (which is usually just investing, or chart-chasing), then this course will be A REVELATION. If you’re coming from an economics degree, this course will destroy some myths that you might have got from academia. The economics professors know about theory; this course is taught by actual traders.

It will clarify EXACTLY what trading is, and how to quantify the process, at a progressional level. There’s a ‘top down’ process, of establishing macroeconomic trends, so you know which trading ideas to pursue and when. Then there’s a ‘bottom up’ process of assessing whether something is actually a tradable idea. Then there’s plenty on the fundamentals of actually MANAGING a portfolio – which you would never guess if someone didn’t tell you.

The same goes for the whole course, to be honest. Once you’ve completed it, you realise that there really isn’t any other way to trade. This is how it’s done, take it or leave. It’s just common sense.

The real value of the course is the spreadsheets that accompany the videos. Compiling spreadsheet data resources on your own would take forever. You’ll end up with a library of spreadsheets that cover everything, from keeping track of trends, data releases, managing the business, calculating your trading stats, and filtering ideas.

And yes, there’s a few videos devoted to trading psychology and technical analysis. But quite frankly, this is (rightfully) a tiny portion of the course, because this this the easiest information to digest.

Why Did I Do It?

After I already took the much smaller IPLT (which I review here), it took a few months before I invested in the PTM. What happened between finishing the IPLT and paying for PTM?

I don’t understand how anyone can take IPLT (Introduction To Professional Level Trading) and not get curious. I think its very rare for someone to do the IPLT and just call it quits. You will want to know more. My curiosity just got to the point where I had to see what was in this PTM course. I simply bought it, digested all the information, without any expectation of where it would lead. It was as simple as that.

You can jump straight into the PTM. I wanted to ease in slowly, so I took the smaller course first. But all the key information is in the PTM. There are perhaps 1 or 2 moments in PTM where I was glad I took the IPLT as a starter, because it refined my understanding. Other than that, jumping into PTM is perfectly acceptable.

Is it actually worth the money?

I’ll be quick: yes.

Without the proprietary knowledge of actual, proven, successful traders, who have worked in the investment bank and hedge fund industry, the average person is just spinning their wheels and ‘guessing’ their way through financial markets.

You’ll be scratching your head forever, trying to put the pieces together, and if you ever do, you probably would have lost so much money, that you’re beyond saving anyway, so why bother.

I think the internet age tricks us into thinking that an abundance of free information is always a good thing. Sorry, but if the information is given freely, then it’s time to be honest: it’s not valuable enough. If you’re being taught by someone who cannot produce a track record, then likely, they know as much as you do.

Having been through the course, learnt the information, passed the exam, and implemented what I’ve learnt, I can say that it’s just common sense.

Now, I want to be clear: this course is obviously designed for a wide audience. That means the information – although its a lot – is FUNDAMENTAL. So consider this course as your first big leap into professional trading. It’s got everything you need to get started, but your results are going to be dependent on your ability to be self-sufficient and diligently and accurately implement what you’ve learnt.

If you complete a fundamental course in anything, you’re going to have a good start. But you’ve got be honest with yourself: the journey is still just beginning. Having said that, although this course is just the start, consider it the best start you’re going to get.

The EXAM! (Why take it? How to prepare?)

Finally, I’m going to talk a bit about the exam. All ITPM courses come with an exam at the end, which is optional.

I highly recommend that you treat this like a university course, set a deadline to take the exam, and create a revision schedule. Why? Depending on your goals, you’ll want to take and pass every ITPM exam.

If you’re a student looking to break into the professional industry, the certificates act as qualifications that can be independently verified by ITPM, with Anton Kreil as your reference. These courses leapfrog over academic understanding of markets and are practically minded, so there’s a possibility they will be favoured over purely academic qualifications.

There’s a possibility of eventually managing ITPM’s own retail trading fund, and getting paid a performance fee. This is by invitation only, but to even be considered, you have to have passed ITPM’s exams.

Finally, if you pass the exams, you can open a managed account with the institute, meaning that they will oversea your trades and can independently verify your trading history. Again, this is essential if you want to apply for a job as a trader, or you eventually want to manage money in some capacity.

This is a major part of why I’m so positive about ITPM, because they’ve built a very positive ‘everybody wins’ model. If you learn, and trade well. If you trade well, you can potentially manage money.

The mistake some people make with the exam is that they think it’s a license to print money. All the mark represents is your internalized knowledge. Implementation is where the journey really begins.

How to prepare for the exam? I’ll write a full post about this subject, but in short: I watched the whole course, taking notes on an iPad. I watched the whole course again, refining my notes. I then re-wrote my notes on paper. As I read through my paper notes I could hear Anton’s voice, which was a sign that the information is sticking. The whole process took 1 month. I booked a quiet hotel business centre meeting room (I know this hotel that has booths that is perfect for sitting exams), and quietly worked through the timed (2 hours!) exam, sipping coffee throughout. You find out your mark instantly. Do the exam; there’s only upside.

Summary

So in summary, I think anyone would get a lot form this course. My only regret is not doing it sooner. It’s changed how I trade, opened doors, and I mark it as a major turning point. I’m grateful that this course exists, as alternatives education out there just don’t come close.