I want to discuss a company I believe will benefit from recent geopolitical events. Normally, these events don’t have a lasting impact on markets, often causing short, sharp changes, like fluctuations in oil prices due to issues in the Middle East.

We’ve seen this recently with Russia’s actions in Ukraine affecting commodity prices. While these changes usually stabilize as people find alternative sources and methods of production, I see an opportunity here. But before delving into the geopolitical event, let’s talk about the company itself: Zim Integrated Services.

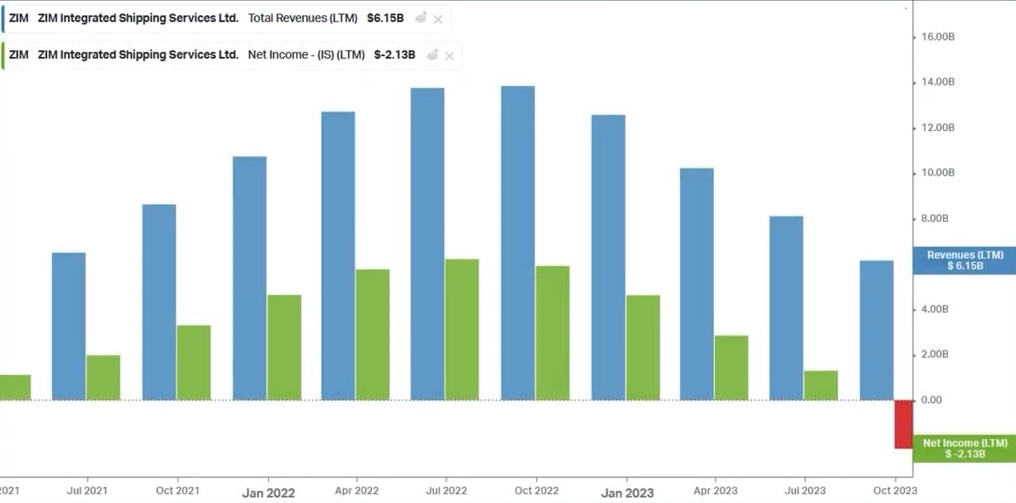

Zim is a shipping company that’s been listed for about three or four years. Initially priced at $15, it’s now trading around $12 or $13, slightly up today. This might not seem like a significant return, but over time, it has peaked at over $80 and paid out $40 in dividends.

Despite the current lower share price, if you had bought in at the IPO and held on, you’d have received a total return of over 100% due to the dividends. It’s been quite a rollercoaster ride driven by high fixed costs for ships and volatile revenue.

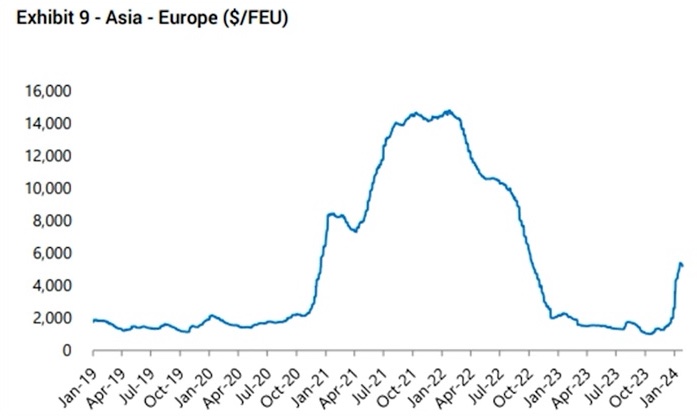

Recently, sales prices have fluctuated dramatically, from as low as $2,000 to as high as $16,000. The opportunity lies in the current upward trend in prices, which could generate substantial cash flow.

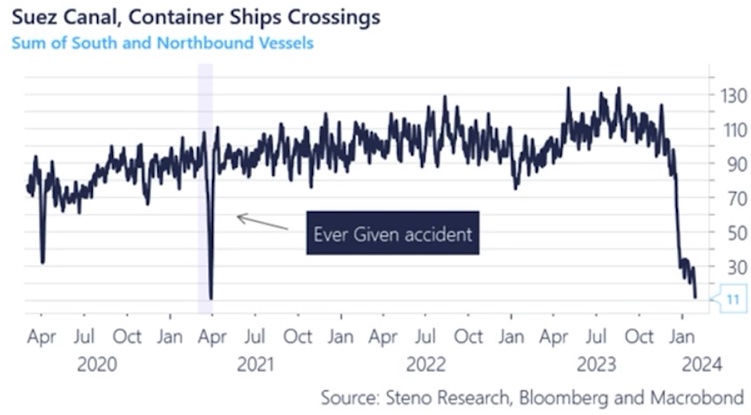

Now, let’s talk about the geopolitical event. There’s been significant turmoil in the Middle East, leading to attacks on commercial shipping in the Red Sea and Suez Canal. Without delving into the politics, it’s important to note that ships are avoiding these routes, opting for alternative paths.

As shown by the decreasing traffic volume, many ships are now circumnavigating Africa. This means longer journeys and higher costs for shipping companies like Zim. Consequently, prices are on the rise, which bodes well for Zim’s profitability, as indicated by the price chart for routes to Europe.

Traffic in the Trans-Pacific region is much more crucial. Looking at this chart, you can see prices going from under $3,000 to over £4,000. What’s the significance? Zim has been under immense pressure because recent prices have been well below $2,000. This has led to negative cash flow and reduced utilization rates, impacting profits.

Everything is on a downward trend now. I see this as an opportunity with more downside protection in our structure. However, there’s also symmetrical risk because although the share price has risen from its lows, it hasn’t factored in these changes much.

If prices remain at these levels, even for a short while, cash generation will be remarkable. If this persists for three or four months, we’ll likely see a significantly higher share price. Dividends totaling $40 have been paid over three years, twice exceeding the current share price. Their dividend policy, with a payout ratio of 30% to 50%, will attract investors. One key factor is that if traffic through the Suez Canal is disrupted, it has to reroute, affecting trade.

So what’s the takeaway from these net profit and revenue charts? They’re quite volatile. The recent quarters have been negative, but I anticipate a strong turnaround. Cash flow looks robust. Even based on conservative forecasts, we’re expecting enough cash relative to our market value.

Essentially, the entire market value could be generated over the next 18 months. If this happens, the share price will likely surge, possibly reaching $30 to $40, given the ongoing dispute.

Despite this positive cash flow, the market hasn’t fully caught on. Only one analyst has upgraded their numbers so far. But as more analysts follow suit in March, it could lead to a significant boost in share prices.

This situation hinges on events in the Middle East. If there’s a ceasefire or if traffic through the Suez Canal resumes, things could calm down. However, I believe there’s been enough cash generation to support the current share price and even drive it higher. Regardless, I’m structuring my trades with asymmetric risk, so if things don’t pan out, it won’t hurt too much.

I’m considering buying July call options, which are currently priced around $2. This is a volatile market with high fixed costs, but as revenues rise and costs stabilize, profits should increase, benefiting investors, especially with the 30% to 50% dividend payout policy.

I might also sell some March $15 call options to offset the cost, creating a 2-to-1 ratio. If we see upgrades, the potential for profit could rise significantly. This trade is a bit unconventional, but I see over 100% upside potential from the current share price, hence why I’m considering July 15 calls.

Geopolitical trades are rare for me, but given the current situation, I think it’s worth a shot. If things don’t pan out, well, that’s the risk we take.