Chris Quill: Today, we have Edward Shek and Jason MacDonald, both senior trading mentors in the IT and BPM sectors. They’ll discuss their views on markets and their portfolios. Let’s kick off with Jason. What are your thoughts, Jason?

Jason: Good to be back. Let’s start with some basic observations. This year has had an interesting start, quite different from last year. I believe this year will be good for stock picking, unlike last year when the market’s direction was clearer.

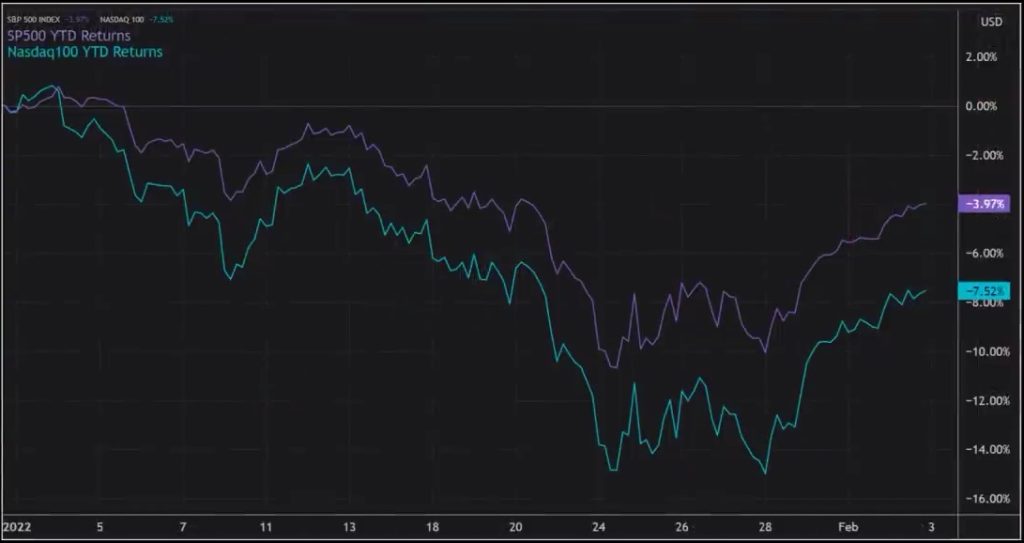

It’s a real stock picker’s market. Despite a rough start with indexes and some mid-cap growth stocks taking hits, recent trends show recovery. For example, the VIX dropped below 22 for the first time since mid-January, WTI is around $90, and the S&P and NASDAQ 100 have recovered a lot of their year-to-date losses.

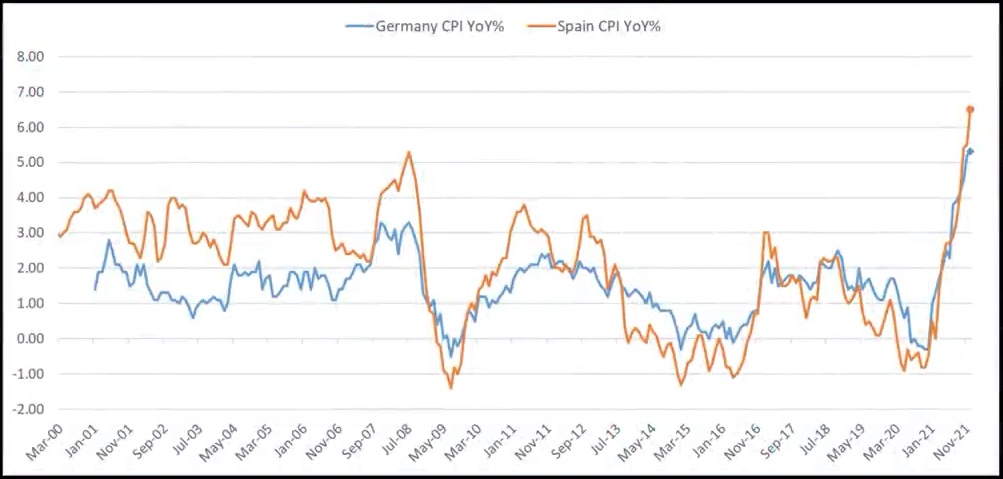

I want to touch on European inflation. German numbers for January showed a 5.1% increase from last year, down from the previous month’s peak of 5.7%, but still higher than expected. Similar trends are seen in Spain, with a 6.1% increase in CPI for January, above expectations. Inflation remains a concern in Europe.

Christine Lagarde, head of the ECB, recently projected a return to below 2% inflation by year-end and further decline in 2023-24. This is notable given the ECB’s deposit rates remain at a record low of -50 basis points since 2014. Despite Lagarde’s stance of no rate hikes in 2022, the market predicts otherwise.

Interest rate futures suggest a ten basis points increase in September and a total of 25 basis points by year-end. Negative yielding euro-denominated debt has reduced significantly, impacting global yields. The ECB’s balance sheet stands at 62% of estimated 2022 nominal GDP for the Eurozone, higher than the Fed’s 35% of U.S. GDP.

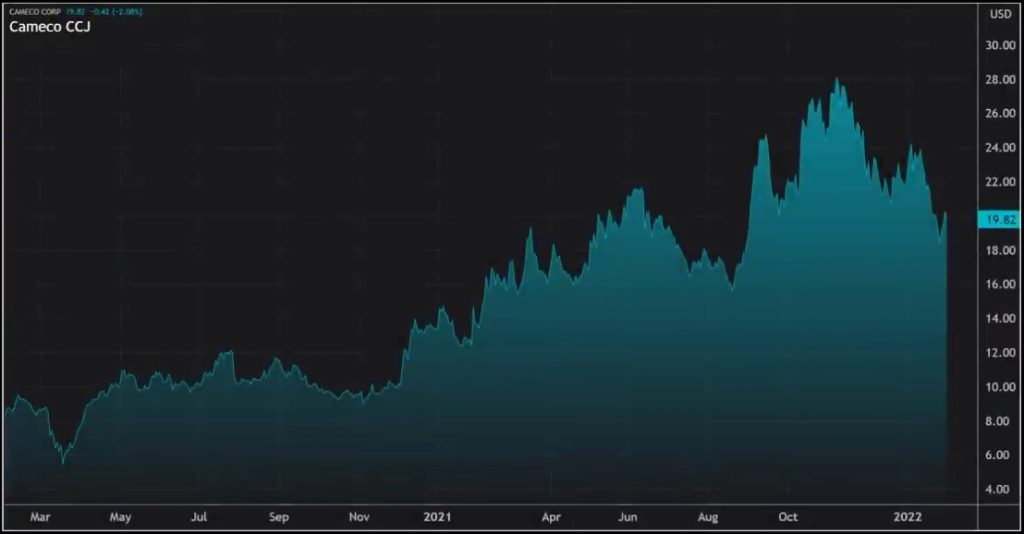

Moving on to my high conviction idea for this week, Cameco (CCJ), a North American uranium miner, caught my attention. With a market cap of $7.75 billion and a share price of $20.24, Cameco holds a dominant position in uranium mining globally. Their uranium products are vital for generating clean electricity in nuclear power plants worldwide.

Cameco explores for uranium across the Americas, Australia, and Asia, and produces uranium oxide concentrate. They own one of four conversion facilities globally, making it a specialized business with long lead times. Only six operators worldwide can meet global uranium demand, historically secured through long-term contracts.

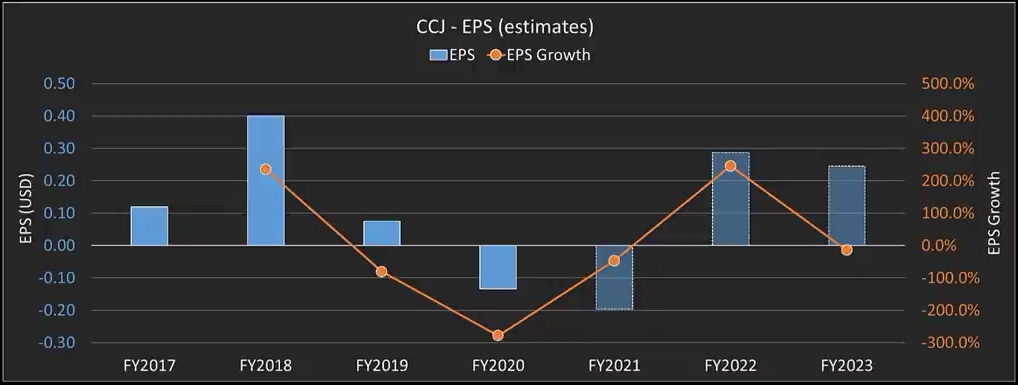

Quantitatively, Cameco’s outlook is promising, with a projected swing from a loss of $0.19 per share in 2021 to a profit of $0.28 per share in 2022. Analysts estimate $0.24 EPS for 2023, signaling significant growth potential.

In percentage terms, the earnings for 2023 aren’t likely to drop. The stock’s P basis is 68 times for 2022 and 79 times for 2023. Its dividend yield is low at 32 basis points, which is better than many euro-denominated debts.

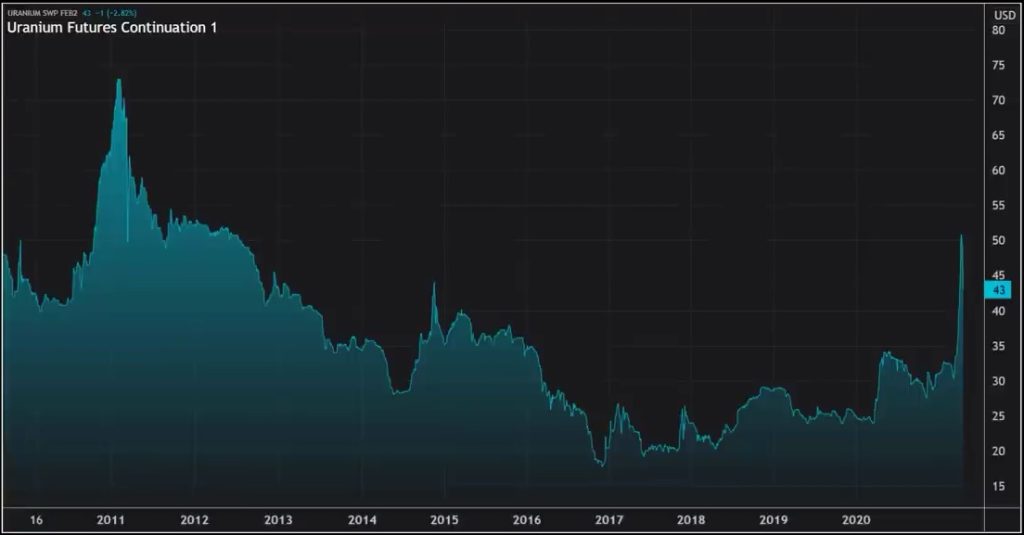

The macro behind this idea traces back to the Fukushima accident in Japan in March 2011, which marked the start of the uranium bear market. It wasn’t until the end of 2019, almost nine years later, that supply began to tighten and balance with demand. Since then, uranium prices have gradually improved.

Uranium operates on a long-term cycle, unique in commodities. Supply and demand changes take time to reflect in prices, sometimes spanning a decade. For instance, it wasn’t until around 2021 that we saw a stabilizing effect on prices after Fukushima in 2011.

Last year, consumption exceeded mining output by £12 million, contributing to a growing deficit. Uranium demand is rising, with about 50 reactors under construction globally compared to a stock of 440.

Production cuts have removed about 20% of demand from the market yearly. Even with potential replacements, it’s unlikely to cover the shortfall. Some estimate miners need prices above $60 to meet demand.

Utilities haven’t rushed into long-term contracts due to low spot prices, but the demand for uranium is significant, requiring contracts for one and a half billion pounds over the next decade.

The company is banking on high uranium prices, despite not appearing cheap by traditional metrics. Its market cap has grown, indicating potential upside.

The uranium market is at a critical juncture after a decade-long bear market. Potential threats include opaque ownership structures, like the Kazakhstan government’s control of the largest uranium miner.

Looking ahead, upgrades to EPS for 2022 and 2023 are anticipated, along with a possible spike in uranium prices. The next earnings report is scheduled for next week, with a target stock price of 2425 by the end of March. Options trading is also considered, alongside holding stock.

Chris: That sounds like a great idea! It’s good to hear about something in the energy sector that could lead to high-growth ETFs. Just a reminder, these aren’t standalone stock ideas. They’re part of each manager’s long equity portfolio, expressing a particular bias and risk tolerance.

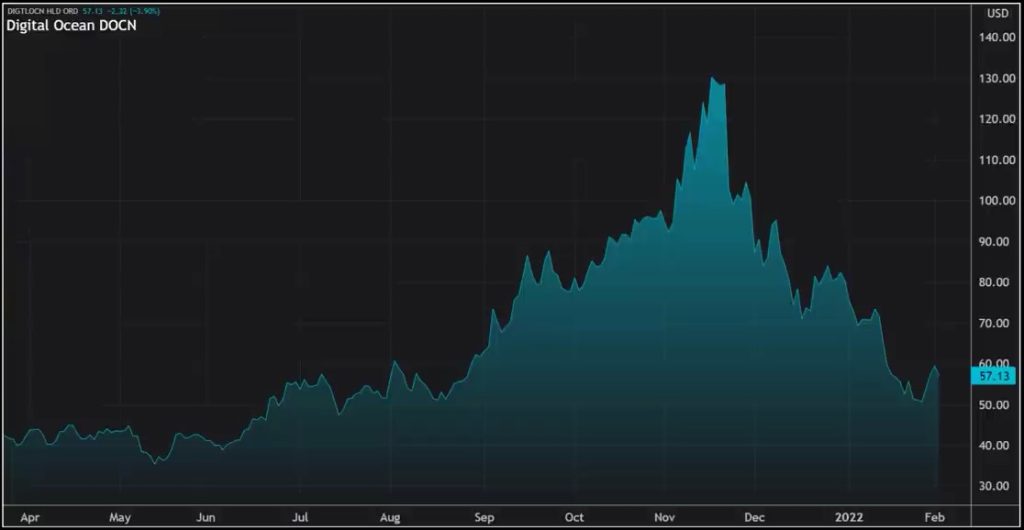

Ed: To bring it up to date, my first move was into Digital Ocean. But lately, I’ve been reducing my net short position and adding tech to the portfolio. It’s not about a technical bounce; I’m looking at stocks that have dropped significantly and might see some technical upside.

I’m not making a strong call on inflation. It’s more about adjusting to being effectively flat or slightly lower on tech. So, let’s talk about Digital Ocean. It’s a company worth six and a half billion dollars, providing cloud computing platforms for developers, startups, and small to medium-sized businesses. It simplifies cloud computing, allowing developers to deploy and scale applications across computing, networking, and storage.

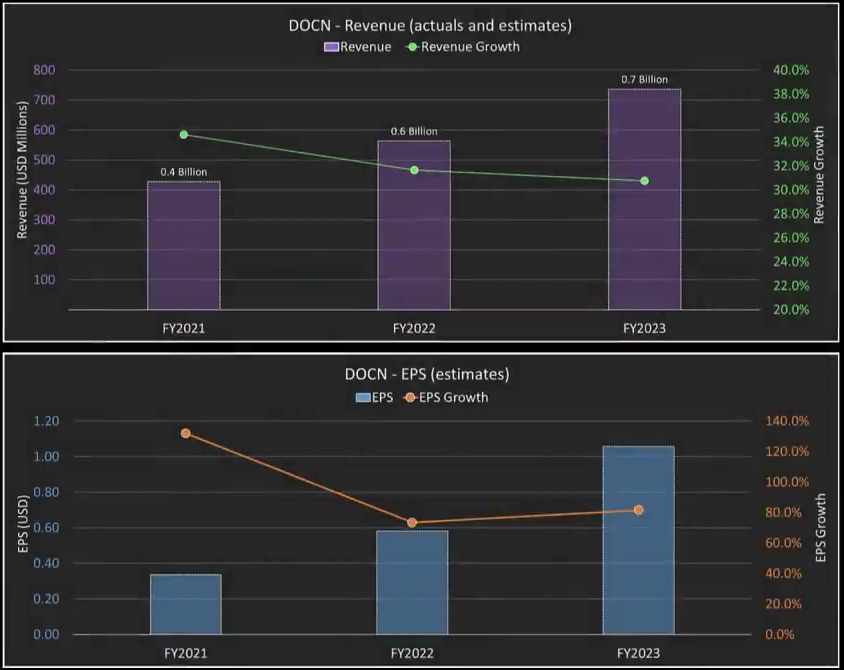

What’s interesting is how the market has reacted lately. Before, a good-looking set of numbers might have indicated a stock would rally. But now, with this company, even though their revenue and earnings are up significantly, the stock is down. However, when I look at the numbers, I see that earnings are still being upgraded, which is crucial.

Looking ahead, the company is projected to see strong revenue growth for the next couple of years. Earnings are also expected to increase substantially. The valuation has come down, but it’s still a question of whether it’s too high or too low. Ultimately, what matters is the guidance they provide.

As expectations for interest rates rise, valuation multiples will likely compress. So, for stocks to go up, we need to see EPS guidance increasing. It’s all about the outlook, especially for stock picking. Comparing with competitors like Toyota, we see different growth trajectories and valuation metrics, which affect our interest.

Now, diving into the company’s performance metrics, we see positive trends in average recurring revenue, revenue per user, and client retention. These metrics indicate a growing and more profitable customer base, which is crucial for future earnings growth.

Looking at the market landscape, the company operates in a rapidly growing sector, and they’re positioned as market leaders. They’re expanding their product offerings to capture more market share, which is promising.

One of the appealing aspects is their scalable product and open-source model, which offers flexibility and cost-effectiveness to customers. As for entry points, the recent price drop presents a potentially attractive opportunity.

However, it’s essential to consider the broader market conditions and adjust trading strategies accordingly. For example, I recently adjusted my options spread strategy based on the performance of similar stocks like Atlassian.

Overall, it’s about finding the right balance between seizing opportunities and managing risks in a dynamic market environment.

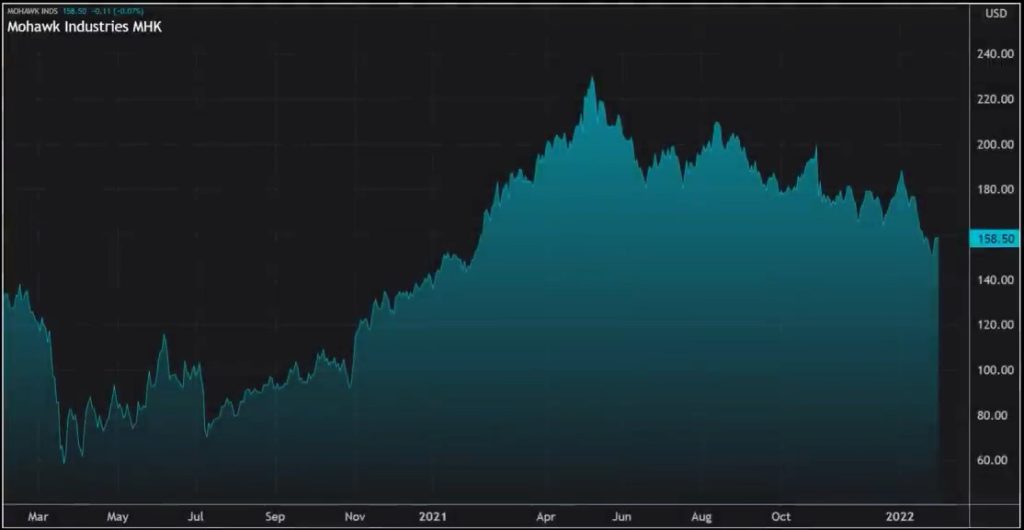

Okay, so I’ve got another idea. It’s not as strong as the first one, but still worth considering. The company is called Mohawk Industries, ticker symbol MHK, with a market cap of $10.7 billion and a closing price of $958.61. They manufacture flooring products for homes and businesses.

They offer a variety of flooring like carpets, rugs, tiles, and vinyl in many countries including the US, Australia, Brazil, Canada, Europe, India, Malaysia, Mexico, New Zealand, and Russia. They’ve split their business into three parts: Flooring North America, Global Ceramic, and Flooring Rest of the World.

The North America segment is the biggest, making up 37.5% of their sales in 2020, offering carpets, rugs, hardwood, laminate, and luxury vinyl tiles. The Global Ceramic segment is almost as large, at 35.9% of sales, offering ceramic and porcelain tiles. The smallest segment, Flooring Rest of the World, makes up 26.5% of sales.

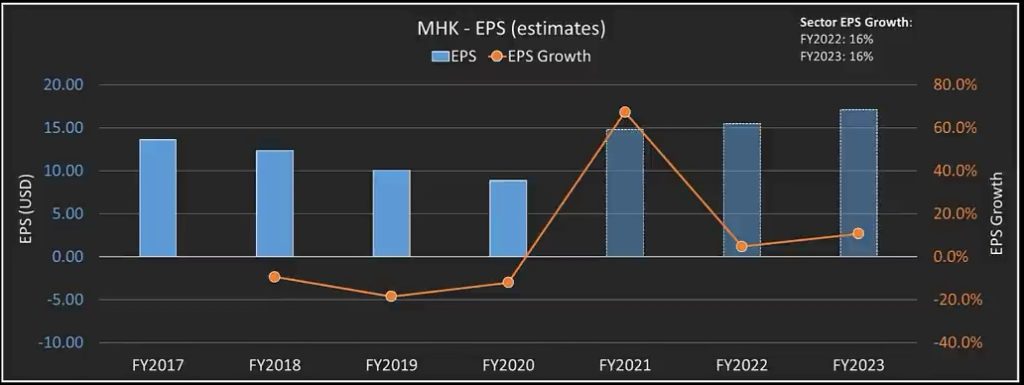

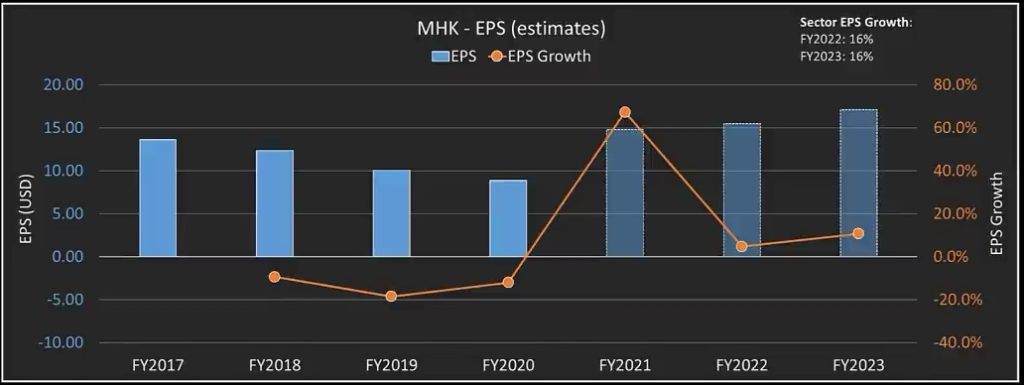

Though their financials might not look great right now, they’re expected to grow their earnings per share (EPS) this year to $15.54 and $17.11 next year, with a growth rate of 22.5% this year and double digits next year, compared to their sector’s predicted 16% growth each year.

They’re trading at a discount compared to their peers, at ten times this year’s earnings and nine times next year’s, while the sector is trading at 22 times this year and 19 times next year.

Despite the financials, Mohawk has a strong market presence with over 750 trucks for distribution, making them a major player in the US flooring market with 25.1% market share. They’ve had some ups and downs, but are working on turning things around.

Their recent strategy includes resolving manufacturing issues, implementing cost-cutting measures, and increasing prices across their products and geographies. They’ve also bought back nearly $500 million worth of stock in the first nine months of last year.

Now, considering the market cap is $10 billion in Q3, they’ve ramped up buybacks significantly, almost doubling from $123 million to $209 million per quarter. In mid-September, they’ve greenlit an extra $500 million for stock repurchases, which is around 10% of their market cap. But this hasn’t hurt their balance sheet much, with net debt at $1.6 billion, less than one times 2021 EBITDA.

Their Q3 operating income, the latest data we have, covers interest expenses 24 times over. There’s room for upgrades, with ten holds, two sells, and 26 buys. Maybe all the bad news is priced in now, with low short interest and the CEO holding 14.5% of shares.

Their last earnings report was broad, with adjusted EPS at $3.95 per share versus estimates of $3.81, but Q4 guidance was lowered to $3.82 to $3.90 due to higher European costs and price increases across the board since the start of the year.

One catalyst might be the belief that all the bad news is already reflected in the stock price. Margins are improving, and next week’s earnings could move the market. I’ve set a bullish target, aiming for a 20% increase by the end of April, around $185 to $188.