Chris Quill: We’ve got Jason McDonald and Ben Berggreen joining me. Welcome to the show once again. And Jason, I think we’ll start with you this week. Why don’t you let us know what you’ve been thinking about?

Jason McDonald: So I’ve actually got two short ideas today. As everyone knows, we are a long/short guys. So we’re not out there making heroic directional views on the market. It’s very much a case of building a long/short portfolio. I’m going to go into my first short idea, which is a company that I’m sure everyone’s familiar with.

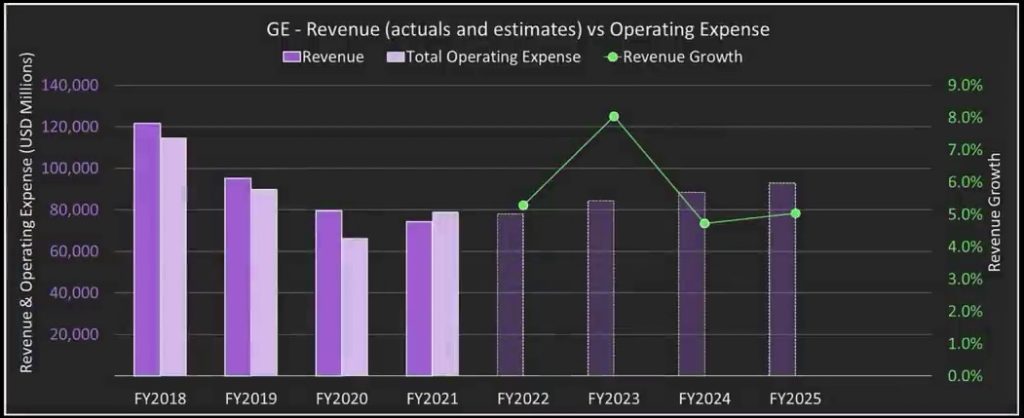

So the company is General Electric. Market cap is $100 billion net debt, just shy of $20 billion, which means it has an enterprise value of around $120 billion a share. Price as of last night’s close, $94.90.

So, of course, they’re involved in jet engines, airframes, energy production solutions. So things like offshore wind turbines, medical imaging technology. And as you will be aware, there’s also a leasing and financial services aspect to the business. They’ve got a few operating segments along which they have their reporting lines. So the most important one being the power segment, which is steam and gas turbines, power generation services, generators, gas power.

Within that, they’ve got the power services and the gas power systems businesses within as a subsegment of the past segment, they’ve also got something they call the power portfolio, which is stuff like the Hitachi nuclear business and the Steam Power Systems business. So that’s the power segment. They have an aviation segment, as everyone knows, where they produce commercial jet engines and components and provide services and the aftermarket for those as a healthcare segment.

So that’s the medical imaging and the the patient monitoring technology. And they have a renewable energy segment, which is where the offshore wind turbines business and the blades for both onshore and offshore wind turbines is housed. So onto the quotes, as we always do. Now, this is a bit of a rebound situation for General Electric this year.

They’ve got very strong EPS growth both this year and next year. So for 2022, we’re looking at predicted EPS growth of just shy of 60% to 56% and earnings growth predicted for next year, 2023 of 60%. In terms of the PE ratio you’re looking at 29x PE multiple for 2022 and PE coming down to 18x for 2023.

Now, compared to the sector, the sector PE for this year is 19x on average versus GS 29x. And then for next year, basically GE trades in-line on a PE basis. So the PE for GE being 18x and for the sector being 17.5x. In terms of the earnings growth, as I said, GE is really on the rebound this year and next.

So they have much higher growth than the sector for this year and next year. So the sector average growth is around 7% this year and just into double digits, 11% for next year. And lastly, just rounding off on the client side, we’ve got a dividend yield for the company of 33 basis points.

Now, what’s behind the idea? So I’ll go to the macro first. If we look at the sort of the general global industrial production situation, I don’t think it’s any secret that that’s been decelerating even before the recent kind of geopolitical developments. If we look at just the US Purchasing Managers Index for manufacturing that’s been falling since last October, it’s now around the mid-50s for the latest reading, and I wouldn’t be surprised if that comes down lower.

I think that that could continue at least into the summer, if not longer, and I don’t think that it’s just restricted to the US. I think that’s the general global situation. So even before the recent situations have developed, I think we already had a cyclical downturn beginning. Now I just want to be very clear. I’m talking about a slowdown as opposed to a recession at this point, although I do believe that the risks are somewhat skewed to the downside, also at the macro level, referring to the Fed, I think we possibly could be on the verge of a policy mistake here in terms of what the Fed is going to do with interest rates. And we have seen that historically recessions do tend to occur around the Fed making a policy error and also coinciding with high oil prices. And as we know all over the news, we’ve already got at least one of those things. I’m not looking for a recession at the moment, but certainly a cyclical downturn.

So that’s the macro background. On the company specific front, I’d like to start off with looking at their income statement. So in the Q4 reports, the most recent report on a GAAP basis, they lost $3.55. If we strip out the various extraordinary items and adjustments, which are many, that sort of number goes from a loss of $3.55 to a profit of $0.82.

Now, to give you an idea of how complicated and shall we say, opaque, their income statement is the head of industrials at JP Morgan said: “This is the worst disclosure, the least transparent set of numbers we have ever seen in the 20 years following the industrials group.”

So I think fair to say, though, that their income statement and their other financial statements are complex. Now, if we want to make it really simple, what we can see is that for the whole of last year of 2021, they generated revenue of $74.2 billion and they incurred costs of 78.8 billion. So that obviously implies an operating loss of $4.6 billion.

And I think that’s probably what I would focus on here. So that’s number one. Number two, back in November, they announced plans to split the business up by 2024 into three parts. So an aviation company, a healthcare company and an energy company.

So the energy company will actually be the largest part of that business. That would be 46% based on last year’s revenues. And that is a combination of their renewable energy, power and digital businesses. Then you’ve got the aviation business, which would be 30% of last year’s revenues and health care company, which is about 25% of last year’s revenues.

The way they’re going to go about this is that they are going to be building duplicate headquarters management teams and systems and back offices for each new unit, whilst also unwinding the finance division, which people like Ben and I can remember all those years ago when this conglomerate was being put together.

That’s quite a complicated business in its own right. And I just think that the costs of that, the split are going to lead to more onetime hits to the income statement and, you know, possible write downs and stuff, which for me is is another bad point. The company itself, they’ve already earlier this month been guiding expectations lower.

They have been predicting just a couple of weeks ago that organic revenue in the non-financial related businesses for this year going to be experiencing low single digit organic revenue growth. So, that’s that’s pretty anemic and it’s basically guiding expectations lower. And and then lastly, there’s something known as the rule of two times or 2x, which some people might be familiar with.

Industrial companies do have genuine costs of depreciation and interest and taxes in this country, pre depreciation, interest charges and taxes, it looks like it’s on 12 and a half times its all which is hardly demanding. However, once you do tax depreciation, interest and taxes, you’ve got a company that’s now 25x EBITDA.

So, the company’s valuation is around 25 times earnings, which is high. This might not usually make the share price drop, but nowadays, people are more sensitive to high valuations. We’re still waiting for something big to happen that could drive the trade.

Currently, there are 24 analysts covering the company, with 17 of them recommending it as a buy. None of them say to sell it. But as things might not go as well as expected later this year, these recommendations might change. I’m expecting the company’s earnings and revenue to go down, which could lead to recommendation downgrades.

The next earnings report is expected around late April, although the exact date hasn’t been confirmed yet. So, I’m planning my trade for June options, specifically the June 17th expiry. I’m considering a spread between the $90 put and the $80 put.

The stock’s price is fluctuating a bit today, down a bit actually, so the spread might be a bit more expensive today. But you can still get it for around $2.50, which gives us the win-loss ratio we’re aiming for with options trading.

That’s the plan.

Chris: Sounds good. With so many analysts recommending buying and low short interest, there’s plenty of room for agreement. Ben, what’s your idea?

Ben Berggreen: Yeah, I used to work for G.E., handling about $200 billion in pension funds. But when things went south, they shut down the asset management. G.E.’s had a lot of issues lately and doesn’t seem to be improving. Anyway, onto my trade idea. First, let’s talk about a long position.

I’m eyeing Iridium Communication (IRDM), a company valued around $5.25 billion, specializing in satellite communications, vital for global connectivity, especially in remote areas or emergency situations like we’re seeing with Ukraine. Their satellite network, with 75 next-gen satellites in low orbit, offers faster and more stable connections compared to competitors.

Using a screening process, I found IRDM fits the bill: smaller stock, high PE ratios, and potential for future earnings growth. Despite negative earnings this year, forecasts show positive earnings next year, though the numbers are small. The price-to-earnings growth ratio (PEG) is low at 0.41, indicating potential.

Looking at the charts, I see a strong uptrend, especially after COVID. Revenue has been stable, driven partly by post-COVID trends and current geopolitical tensions, like the situation in Ukraine. Their operating income has surged 475% since 2019, and they’re actively buying back shares.

The catalyst for this trade is the growing demand for emergency-preparedness products, reflecting fears of geopolitical instability. I expect a boost in sales and earnings, especially when earnings are released on April 19th. Technical analysis shows the stock is in an uptrend, with potential resistance levels around $43 to $45.

For the trade structure, I’m looking at buying April 40 strike calls due to their liquidity and timing before earnings. Options premiums have decreased recently, offering potential for high returns if the stock rallies. Though usually, I’d use spreads, the thin options book suggests outright buying is the best move here.

Chris: That was an interesting insight into how to structure using options. Thanks for that. What’s your next idea, Jason?

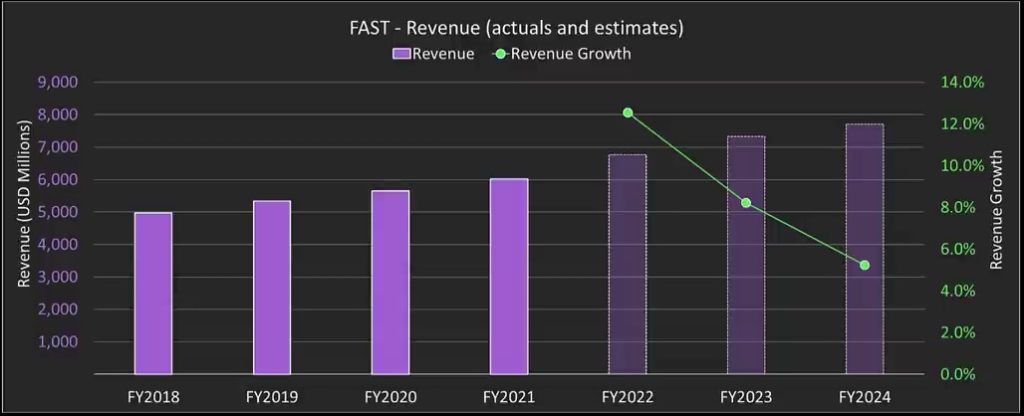

Jason MacDonald: Yeah, let’s dive into it. The company we’re discussing is Fastenal, ticker symbol FAST. They mainly distribute industrial and construction supplies, mainly in North America. They have two main product lines: fasteners and miscellaneous industrial and construction supplies. Fasteners include bolts, nuts, screws, and more, while the miscellaneous line includes things like pins, keys, and concrete anchors.

These products are widely used in manufacturing, construction, and machine maintenance. Their customers are mainly in manufacturing and nonresidential construction markets, serving OEMs and MRO operations, as well as contractors. In terms of financials, their earnings growth this year is expected to be 12.5%, compared to the sector’s 21.5%, with a PE ratio of 32x this year’s earnings.

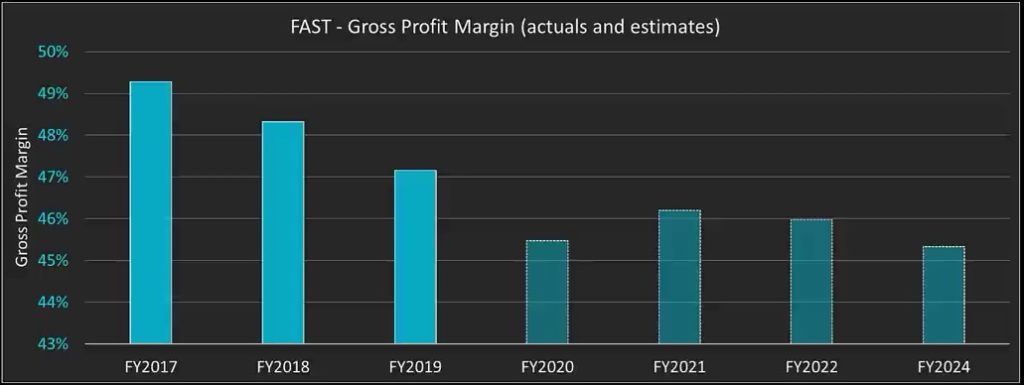

Fastenal is trading at a premium compared to its sector peers, with a dividend yield of over 2% and low short interest. They’ve been around for a while, but have diversified beyond fasteners, which now account for only a third of their sales.

Their management is praised for quick adaptation during the pandemic, shifting to PPE production, which boosted their revenues. They benefit from inflation due to their large inventory and have a healthy balance sheet with low debt.

However, there are concerns about competition, particularly from Affiliated Distributors, a cooperative with significant market share gains. Fastenal’s expansion into less profitable areas has led to declining margins, compounded by sluggish online sales growth compared to competitors.

Given these factors and the changing economic environment, there’s a bearish outlook on Fastenal. A longer-term strategy involving put spreads is suggested, with a target price of $50 or lower. This strategy offers a risk-reward ratio of over 3 to 1.

Chris: Thorough analysis were mentioned. Thanks, Jason. Now, Ben, let’s hear your second idea.

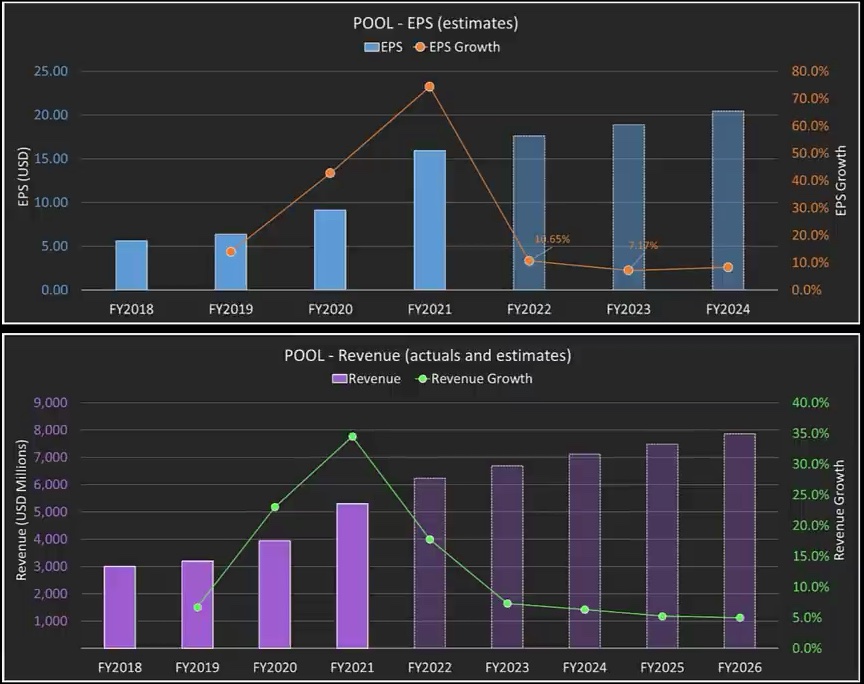

Ben: So, I’ll take the opposite approach—something simple and quick, with a positive spin. I’m looking at a company called Pool Corp, which deals mainly in building swimming pools. It’s a straightforward business with a $19 billion market cap. The stock did well during the home-buying frenzy, but now it’s slowing down, along with the homebuilders. Pool Corp is closely tied to the housing market, as shown by its correlation with major homebuilders like Lennar Corp and D.R. Horton.

The company’s growth is slowing, with lower earnings forecasts for this year and the next. They’ve also increased their debt significantly, which could be a problem if demand drops, especially with rising interest rates. Housing market indicators are showing a slowdown, with building permits declining and inflation impacting material costs. It’s becoming less affordable for people to buy both houses and pools.

Looking at the technical side, the stock seems to be forming a classic head and shoulders pattern, indicating a potential downturn. I’m considering shorting the stock with a stop at $500 to control risk, aiming for a target of $330. The risk-reward ratio looks favorable, despite the possibility of sudden price movements.

That’s my take on Pool Corp—a simple business with straightforward drivers. Thanks for having me on the show again.

Chris: Alright, we’ll wrap it up here. Thanks to both of you for sharing your insights.