Recently, Fitch, a U.S. credit rating agency, lowered the U.S. credit rating from triple-A to Double-A plus. This is a long-term outlook change, not a short-term one. The last time this happened was in 2011 by Standard Poor’s. What does this mean for your portfolio?

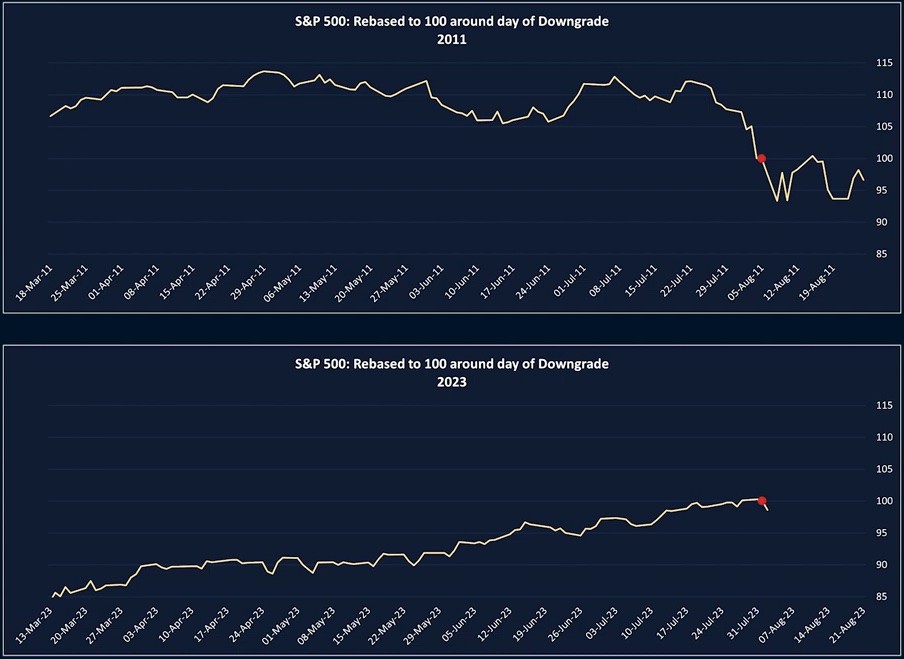

Before reacting hastily, let’s recall 2011. Does this downgrade affect equities? Looking back, when S&P downgraded the debt in 2011, the market sold off significantly. However, this time, despite the downgrade, the market’s reaction was less severe.

In 2011, after the downgrade, the market experienced high volatility, similar to the 2008 financial crisis. Bonds rose as investors sought safety amid equity sell-offs. However, this time, bonds initially rose but later sold off slightly, resulting in slightly higher yields.

Regarding the recession speculation due to the downgrade and uncertainty in Washington, it seems far-fetched. While a recession is possible, it’s unlikely this year based on current data. Fitch’s claim that our interest expenses in 15 years will cause a recession is absurd.

Despite potential market corrections, driven by factors like seasonality or earnings, attributing it solely to the downgrade is mistaken. If yields rise, it doesn’t necessarily mean stocks will decline. It could present buying opportunities in desired stocks and sectors.

There’s a trap being set in the market. Bond markets have been guiding equity markets due to inflation and expected rate hikes. However, this trend has reversed recently. Bonds have declined while stocks have risen unexpectedly.

This divergence is likely due to inflation stabilizing around 3% annually, indicating a healthy job market despite being below the Fed’s target.

The hiking cycle is pretty much done. Inflation happened because there weren’t enough goods, but now supply meets demand. The tricky part is if long term rates rise, there might not be enough interest in long term bonds due to credit worries, even if inflation stays at around 3%.

What happens next is that the bond market could follow stocks, not the other way around. Good earnings and economy news mean stocks rise and bonds fall, leading to higher returns.

This is a shift from the norm where bonds usually did their own thing. This new trend likely won’t change, even with downgrades.

Higher rates can affect consumers by making borrowing expensive. But unless inflation rises significantly or other countries start selling U.S. bonds, rates will follow U.S. economic data and stocks.

If stocks fall due to bad news or a recession, bonds become more attractive, lowering yields. Then the Fed can step in with rate cuts or quantitative easing (QE), which could lower inflation.

So, don’t panic about this downgrade. If stocks drop, the Fed can step in with QE to boost the market, likely keeping inflation in check.

Overall, this downgrade probably won’t cause big changes in the market. The long-term issue of U.S. government debt is concerning, but it’s not an immediate problem.

Instead of getting caught up in events like this, think ahead. Let’s play chess while others play checkers.