Today, let’s talk about last Friday’s jobs report for August and how the market reacted. Despite a slight dip of just over 1% in the equity market, the VIX surged by over 10% since last Thursday’s close.

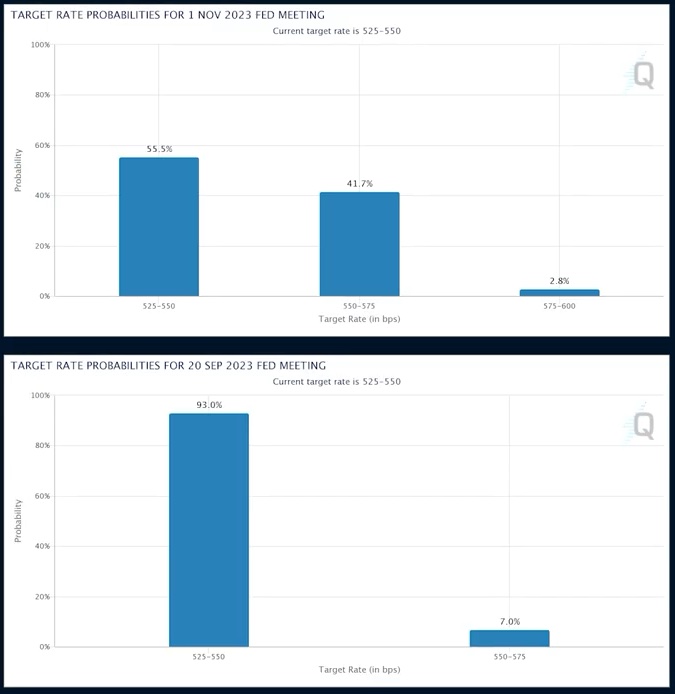

Now, onto the ten-year yield, it’s climbed from 4.1% to nearly 4.3% as of now. What’s surprising is the market’s anticipation of a 50% chance of another rate hike in November, while September is barely factored in. To me, that seems overly optimistic. After reviewing the jobs report, I believe the likelihood of a hike should be close to zero.

Let’s delve into the specifics of the report. Wage growth notably softened, and the headline unemployment figure spiked by 0.3%, a significant jump. Equally noteworthy is the underemployment figure, which rose by 0.4%. These are substantial movements that one would expect to rattle the market more. However, the market seems to interpret them as mildly dovish, although rate movements don’t necessarily imply dovishness.

Another crucial aspect is the evident decline in labor demand, evident from eight consecutive months of negative revisions in employment estimates. Beyond low-paying service roles, the economy hasn’t generated net new jobs since May. Most job additions since then have been in healthcare, primarily comprising part-time nurses or desk-bound roles, which are not conducive to driving economic growth.

Interestingly, the report claims an addition of 6500 jobs in personal laundry services, a sector previously witnessing no more than 700 new jobs. Whether these positions are related to cleaning up after policy decisions remains unclear. Regardless, the employment outlook appears bleak, which aligns with recent trends.

However, this isn’t entirely negative, as the Fed aimed to taper job market growth, a goal seemingly achieved. Perhaps this explains why the equity market remains resilient despite weaker employment data. Yet, I believe the market misjudges the long-term rate curve, particularly regarding oil.

Despite oil hovering around $90, the market views it as inflationary, contrary to my perspective. I’ve been monitoring oil stocks for a while, noting the Fed’s focus solely on core inflation, excluding oil and food prices. With oil at current levels, it adversely impacts the economy and the service sector, suggesting caution in long exposure to this area.

If oil prices remain elevated, it’s likely to hurt the U.S. consumer more than anticipated, potentially leading to deflationary pressures. Conversely, if oil prices retreat, rates could ease as inflation concerns diminish.

So, it’s fine to have lower rates, maybe because the economy’s weakening and demand is down. If that happens, the TLT, which tracks long-term rates, should go up since they move in opposite directions. But what if oil keeps rising?

Imagine oil hitting $100 or more. Eventually, the market will see it’s bad for consumers and that job growth may stall. This could lower core inflation due to decreased demand, causing the TLT to rise and rates to fall.

Looking back, if ten-year rates return to around three and a half percent, the TLT should climb back to 1 to 5.6. Setting up cheap upside call spreads on the option curve with a 4 or 5 to 1 risk-reward ratio seems sensible.

I’ve been one of the few bullish voices in a bearish market, calling for a rally in Treasuries. Setting up these call spreads in TLT offers good risk-reward, whether you’re bullish on equities or expecting a market downturn.

Remember, TLT could rally for many reasons, like oil fluctuation, recession fears, or geopolitical tensions. Being prepared for unexpected shifts is crucial in trading options, offering defined downside risk and potential big gains if your prediction pans out.